July – Pending TDS / TCS Compliances

30th July – Due date of issuing TCS certificate for Quarter 1 of Financial Year 2025-2026 31st July – Due date of filing TDS Returns…

View More July – Pending TDS / TCS CompliancesTDS / TCS Non-Compliance: Costs, Risks and Prevention

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are essential components of India’s tax system to ensure better tax compliance and reduce…

View More TDS / TCS Non-Compliance: Costs, Risks and PreventionTDS Applicability U/S 194Q On Purchased Goods

In the Finance Act of 2021, the Indian government inserted Section 194Q. The Indian government’s intention behind enacting this law was to generate a trail…

View More TDS Applicability U/S 194Q On Purchased GoodsHealthy Practices for Error Free TDS Returns

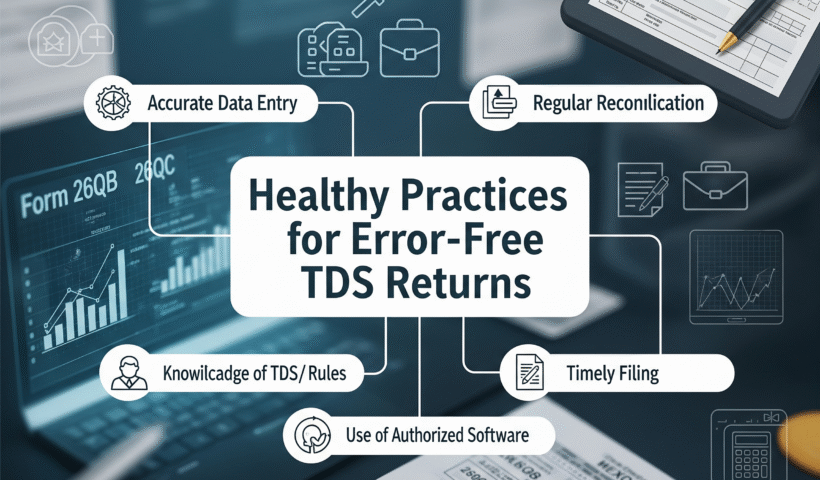

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsSection 195 – TDS on Payments to Non-Residents

What is Section 195? Section 195 of the Income Tax Act, 1961 mandates that any person (including individuals, Hindu Undivided Families (HUFs), firms, or companies)…

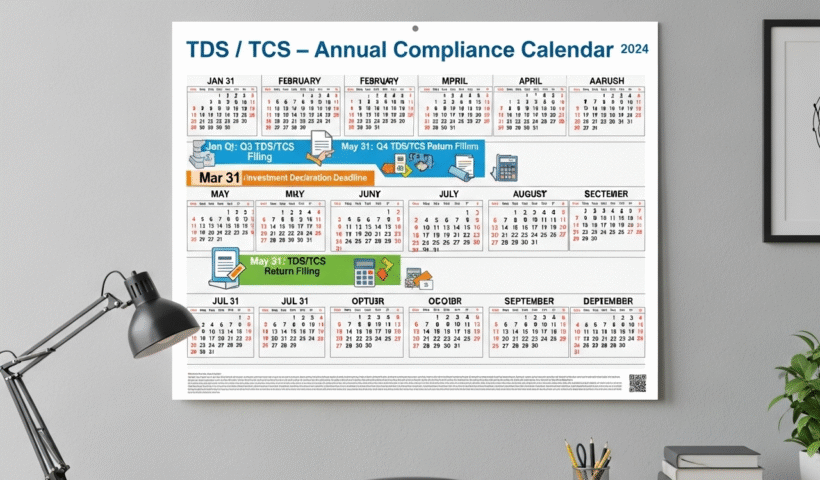

View More Section 195 – TDS on Payments to Non-ResidentsTDS / TCS – Annual Compliance Calendar

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance CalendarSection 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionals

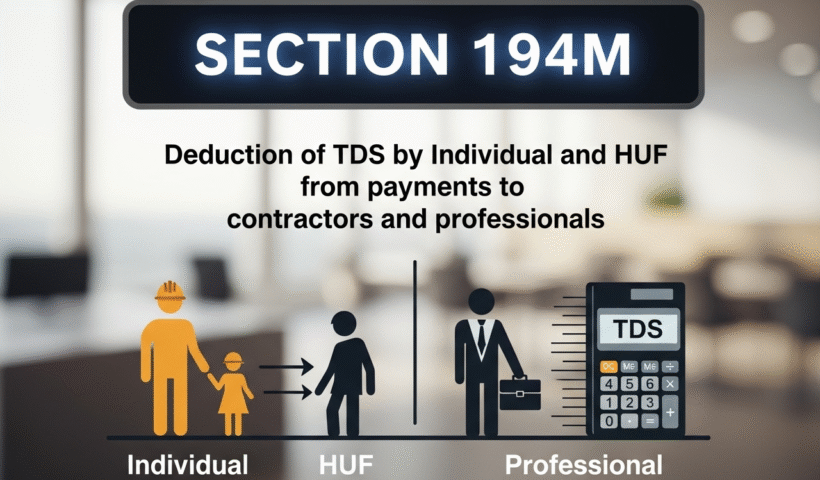

Section 194M, introduced in the Budget of 2019, specifically targets individuals and Hindu Undivided Families (HUFs) who were previously exempt from TDS obligations. This section…

View More Section 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionalsTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

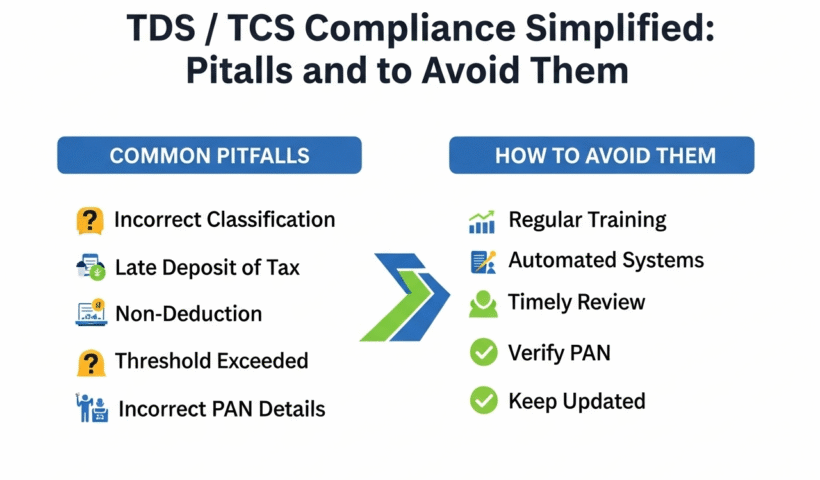

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemSection 206C(1G): TCS on Foreign Remittances and Tour Packages

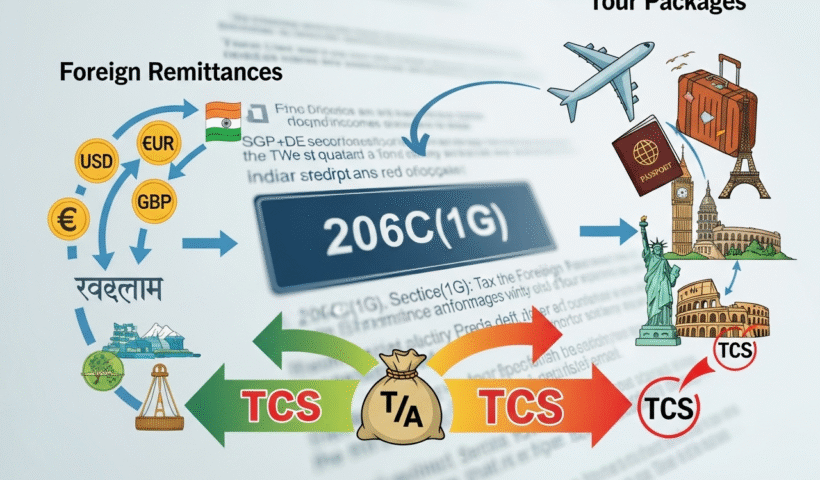

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesSection 194T: TDS on Payments by Partnership Firms to Partners

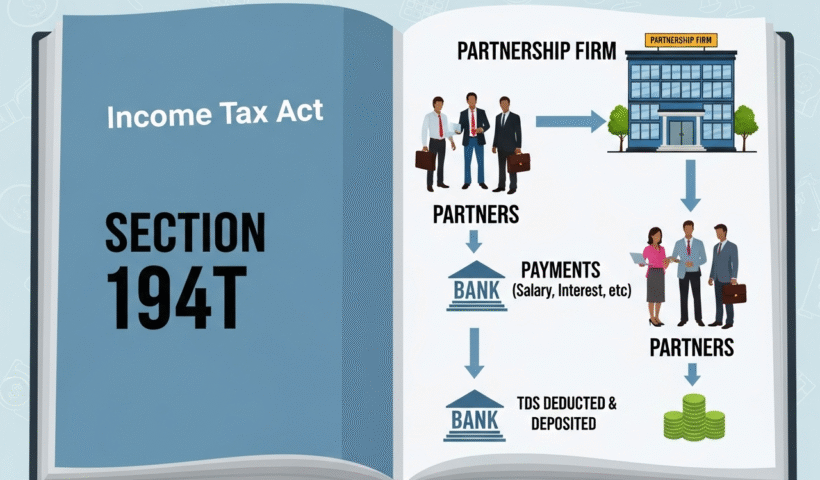

Budget 2024 introduced Section 194T, making certain payments from partnership firms (including LLPs) to partners liable for TDS. Previously, such payments were exempt from TDS,…

View More Section 194T: TDS on Payments by Partnership Firms to Partners