What is the Late payment interest?

When deductor deposits the TDS after due date of deposit, it is a case of late payment and interest will be charged accordingly.

What is the Interest Rate for Late Payment?

- Prior to 1st July 2010-1% per month

- After 1st July 2010-1.5% per month

What is the procedure of calculating interest on Late Payment?

Late Payment interest is calculated @ 1.5% per month or Part of the month from the date of deduction +1 day till date of Deposit.

Procedure of calculating Late Payment:

Procedure of calculating Late Payment:

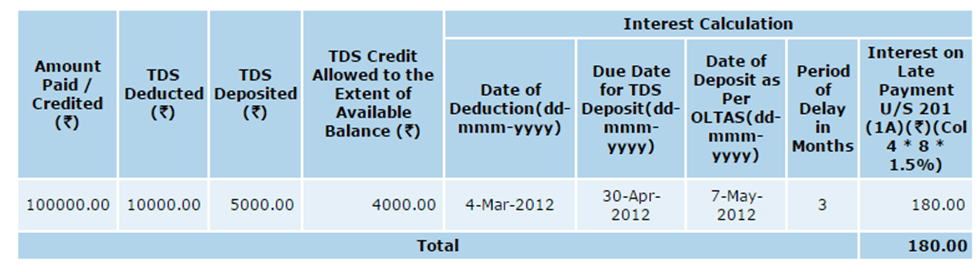

Calculation

No. of months in Defaults = 3 i.e., 4-Mar-12+1 day to 12-May-12

4000*1.5%*3(Months) =180.00

What should I do in case of Late Payment Intimation Received?

Follow the steps mentioned below:

- The default amount will have to be deposited through challan number ITNS – 281 by ticking minor head ‘400’

- Add Challan to statement (C9 correction) using “Online Correction Functionality” available on TRACES as C9 correction has been stopped in Offline Correction

- For closure of late payment default, fill up the fee amount in “interest” column in challan details through Online Correction by clicking on “Request for Correction” under “Default” tab and select Pay 220/LP/LD/LF/ Interest u/s 220 category

- Please note that once the challan is added to the statement using the “Online Correction Functionality” further corrections can also be done by downloading latest Conso File.

- Note: In case of paper return, interest amount should be mentioned in annexure.

What are the facts that should be considered for calculating Late payment interest raised by TDSCPC?

Interest is calculated as per sec. 201 (1A) (ii) of IT act 1961, considering the below mentioned facts:

- Interest is charged from date on which such tax was deducted to the date on which such tax was actually paid

- Interest is chargeable for every month or part of the month on the amount of such tax.

- A month is considered to be a calendar month as per general clauses act

What is the due date for the Quarterly deposit of TDS in special case under rule 30(3)?

Quarterly date of deposited of TDS:-Q1 (Apr to Jun) – 7 July, Q2 (Jul to Sep)- 7 OCT, Q3 (Oct to Dec)- 7 Jan, Q4 (Jan to Mar)- 30th April.

If Extension is given, and then the Due date of Deposited will be considered from?

Late Payment interest will be calculated from the date of deduction but eligibility for extension will be considered from the date of payment/credit.

What is the additional Late Payment Interest?

Additional late payment will arise, while in correction statement, deductor has added new deductee rows and has given credit to deductee against newly paid challan or modified Date of Deduction or have made changes in any unmatched challan against which the TDS payment made.

Source: TRACES