As per section 194IA of the Income Tax Act, buyer is required to deduct tax at source @1% of the amount paid/credited to the seller. Therefore, after processing of 26QB statements, the information will appear in 26AS of buyer & Seller in the following manner:-

Scenario 1

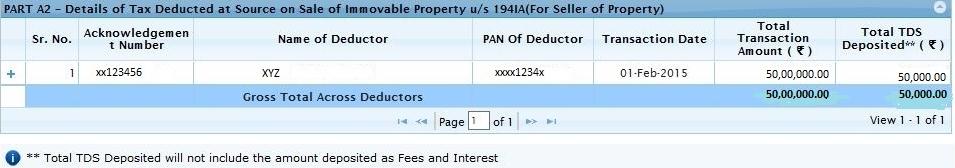

If Buyer has deducted & deposited Rs.50,000/- on payment of Rs.50,00,000/-.

Seller: TDS Credit is reflected in Part A2 of the seller to the extent of 1% of amount paid/credited. This credit is available for claim in ITR by the seller.

Buyer: Total tax deposited by buyer is shown in Part F of 26AS of Buyer for information. Part F information is not available for Claim in ITR of buyer.

Scenario 2: If Buyer has deducted & deposited Rs.60,000/- on payment of Rs.50,00,000/-.

Seller: TDS Credit is reflected in Part A2 of the seller to the extent of 1% of amount paid/credited. This credit is available for claim in ITR by the seller.

Buyer: (ii)Total tax deposited by buyer is shown in Part F of 26AS of Buyer for information. Part F information is not available for Claim in ITR of buyer.

Note: This is only for Information Purpose.

CPC(TDS) is committed to provide best possible services to you.

CPC (TDS) TEAM

Source: TRACES

Hi,

Scenario 2 is applicable in my case. I was looking for the solution for this but i didn’t find anything. You have described in a very good manner. Please let me know How to claim excess amount?