Reference to CBDT Circular No. 05/2024 dated 15th March 2024, the monetary limits has been revised vide Circular No 09/2024 dated 17th September 2024 for…

View More CBDT Circular No. 09/2024 – Enhancement of Monetary Limits on LitigationsMonth: September 2024

Non-applicability of higher TDS / TCS u/s 206AA / 206CC in event of death

As per the recent CBDT Circular No. 08/2024 dated 5th Aug ’24, it has been provided that in the event of death of the Deductee…

View More Non-applicability of higher TDS / TCS u/s 206AA / 206CC in event of deathCorrection Statements: Limited to the Last Six Years

Starting from 1st April 2025, a significant change is being introduced regarding the filing of Correction Statements. Under the current provisions, taxpayers have the flexibility…

View More Correction Statements: Limited to the Last Six YearsConsequences of TDS Defaults and Non-Payment to Government

Understanding TDS: An Overview Tax Deducted at Source (TDS) is a mechanism instituted by the Indian government to ensure the timely collection of tax revenue.…

View More Consequences of TDS Defaults and Non-Payment to GovernmentTDS Under Section 194H – Brokerage & Commission

What is Section 194H? Section 194H of the Income Tax Act is specifically dedicated to TDS deducted on income earned through brokerage or commission by…

View More TDS Under Section 194H – Brokerage & CommissionUnderstanding Correction Statements on TDS: A Six-Year Limitation

What are Correction Statements? Correction statements are critical tools utilized by taxpayers to rectify errors in their Tax Deducted at Source (TDS) filings. These statements…

View More Understanding Correction Statements on TDS: A Six-Year LimitationUnderstanding TDS Under Section 194H: A Guide for Brokers

What is TDS Under Section 194H? TDS, or Tax Deducted at Source, is a crucial component of the Indian taxation system, introduced to collect tax…

View More Understanding TDS Under Section 194H: A Guide for BrokersUnderstanding TDS Under Section 194J: A Complete Guide

Introduction to TDS and Its Importance Tax Deducted at Source (TDS) is a critical aspect of direct taxation in India. It mandates that certain payments…

View More Understanding TDS Under Section 194J: A Complete GuideImportant TDS and TCS Compliance Dates for October 2024

Understanding TDS and TCS Compliance The Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are crucial components of the Indian tax system.…

View More Important TDS and TCS Compliance Dates for October 2024Reduction / Optimization of TDS Rates W.E.F. 1st October ‘24

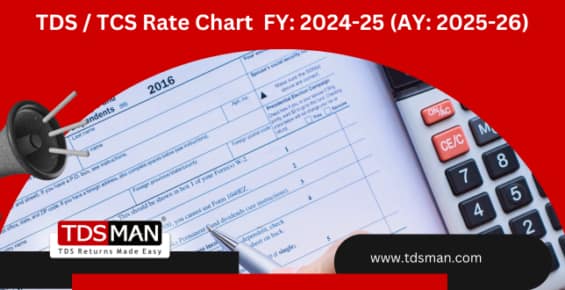

Effective from 1st October 2024, Tax Deducted at Source (TDS) rates have been reduced. These are part of the government’s ongoing efforts to simplify tax…

View More Reduction / Optimization of TDS Rates W.E.F. 1st October ‘24