Once you have completed the process of filing your TDS or TCS returns, the next important step is to generate and distribute the relevant certificates…

View More TRACES: Download & Extract TDS & TCS CertificatesMonth: May 2025

Section 271H: Penalty on taxpayers for not filing TDS or TCS returns

Section 271H of the Income Tax Act, 1961, outlines penalties related to the late filing, non-filing, or furnishing of incorrect information in Tax Deducted at…

View More Section 271H: Penalty on taxpayers for not filing TDS or TCS returnsMay – Pending TDS / TCS Compliances

30th May – Due date of issuing TCS certificate for Quarter 4 of Financial Year 2024-2025 31st May – Due date of filing TDS Returns…

View More May – Pending TDS / TCS CompliancesTDS Certificates – TDSMAN makes it Effortless

Managing TDS / TCS certificates post-return filing often involves multiple steps, interfaces and utilities. But with TDSMAN, everything comes together – neatly and efficiently –…

View More TDS Certificates – TDSMAN makes it EffortlessTDS Deduction on EPF Interest (New Rule)

Employee Provident Fund (EPF) was earlier not subject to tax and was tax-free in the hands of the employee. When a contribution was made, the…

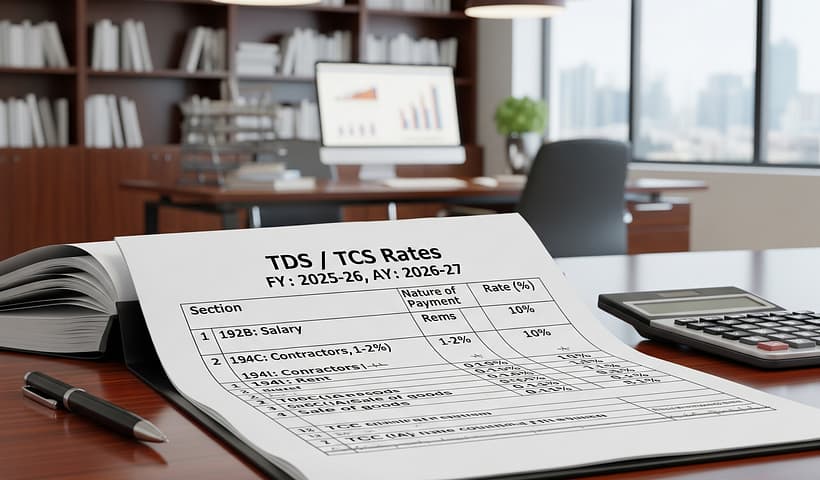

View More TDS Deduction on EPF Interest (New Rule)TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)

A snapshot of the exemptions / deductions applicable for FY: 2024-25 (AY: 2025-26) under the Old & New Tax Regimes are summarized as under: Particulars…

View More Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)Introducing: Free Tax Comparison Tool for Salaried Employees

For most salaried individuals, tax planning starts with a familiar question: Should I stick with the Old Regime or shift to the New one? Both…

View More Introducing: Free Tax Comparison Tool for Salaried EmployeesImportant resources – Form 24Q-Q4 (TDS on Salary)

With the Old & New Regime option given to employees for computing the income tax, it has become a tricky proposition even for the employers.…

View More Important resources – Form 24Q-Q4 (TDS on Salary)Section 276B: Failing to remit Tax Deducted at Source (TDS)

Section 276B of the Income Tax Act, 1961, addresses the consequences for failing to remit Tax Deducted at Source (TDS) to the Central Government within…

View More Section 276B: Failing to remit Tax Deducted at Source (TDS)