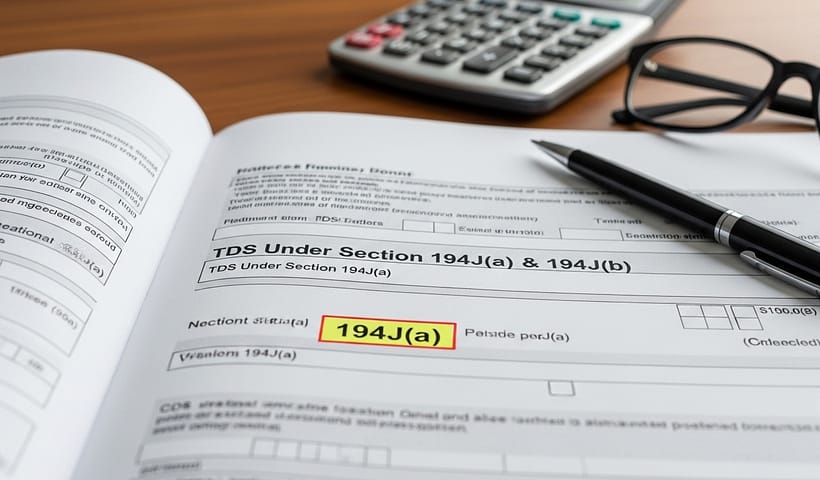

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)Month: June 2025

Consequences of TDS defaults

Failure to deduct taxes or wrong deduction of TDS (non deposit, short deposit or late deposit) : Default/ Failure Section Nature of Demand Quantum of…

View More Consequences of TDS defaultsSection 194LA: TDS on Compensation for Compulsory Acquisition of Immovable Property

Section 194LA of the Income Tax Act, 1961, requires any person (referred to as the “payer”) making a payment to a resident (the “payee”) for…

View More Section 194LA: TDS on Compensation for Compulsory Acquisition of Immovable PropertySection 194O – TDS on Payments by E-Commerce Operators to Participants

Section 194O was introduced in the Union Budget 2020 and came into effect from 1st October 2020. It requires e-commerce operators to deduct TDS on…

View More Section 194O – TDS on Payments by E-Commerce Operators to ParticipantsSection 194S – TDS on the transfer of virtual digital assets and cryptocurrencies

Section 194S of the Income Tax Act was introduced to regulate taxation on transactions involving Virtual Digital Assets (VDAs), including cryptocurrencies and non-fungible tokens (NFTs).…

View More Section 194S – TDS on the transfer of virtual digital assets and cryptocurrenciesSignificance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsCorrection Statements: Limited to the Last Six Years

Starting from 1st April 2025, a significant change is being introduced regarding the filing of Correction Statements. Under the current provisions, taxpayers have the flexibility…

View More Correction Statements: Limited to the Last Six YearsSection 271C: Penalty for failing to deduct TDS

Section 271C of the Income Tax Act, 1961, outlines the penalties for failing to deduct or remit Tax Deducted at Source (TDS) as mandated by…

View More Section 271C: Penalty for failing to deduct TDSTDS / TCS Compliances Reminder for June 2025

7th June 2025 – Due Date for TDS / TCS payment for deductions / collections during May 2025 15th June 2025 – Due date for issuance of TDS Certificates for Quarter 4 of FY: 2024-25…

View More TDS / TCS Compliances Reminder for June 2025