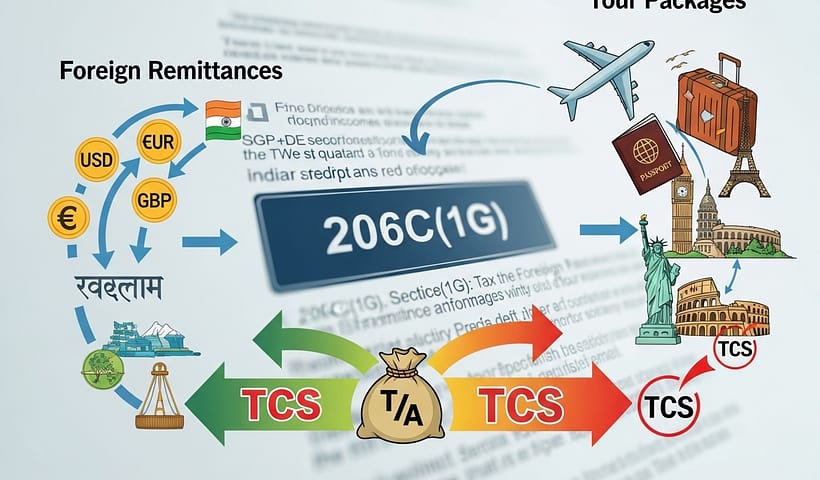

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesDay: July 10, 2025

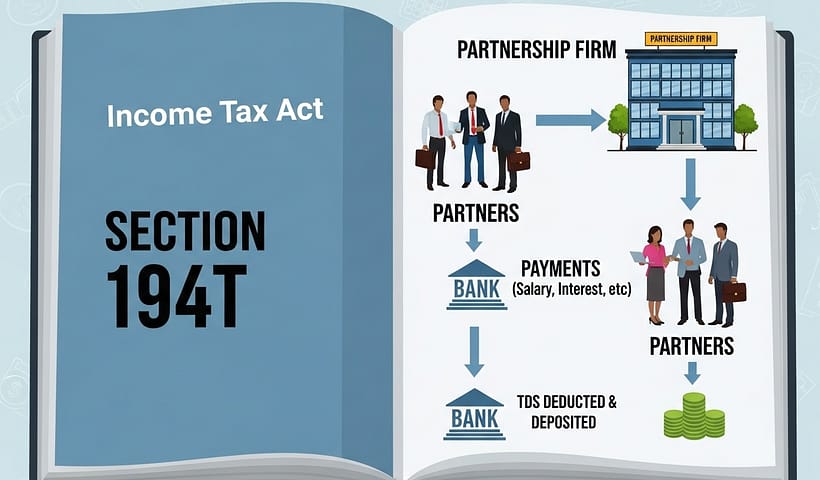

Section 194T: TDS on Payments by Partnership Firms to Partners

Budget 2024 introduced Section 194T, making certain payments from partnership firms (including LLPs) to partners liable for TDS. Previously, such payments were exempt from TDS,…

View More Section 194T: TDS on Payments by Partnership Firms to Partners