Section 194S of the Income Tax Act was introduced to regulate taxation on transactions involving Virtual Digital Assets (VDAs), including cryptocurrencies and non-fungible tokens (NFTs).…

View More Section 194S – TDS on the transfer of virtual digital assets and cryptocurrenciesAuthor: TDSMAN

Correction Statements: Limited to the Last Six Years

Starting from 1st April 2025, a significant change is being introduced regarding the filing of Correction Statements. Under the current provisions, taxpayers have the flexibility…

View More Correction Statements: Limited to the Last Six YearsSection 271C: Penalty for failing to deduct TDS

Section 271C of the Income Tax Act, 1961, outlines the penalties for failing to deduct or remit Tax Deducted at Source (TDS) as mandated by…

View More Section 271C: Penalty for failing to deduct TDSTDS / TCS Compliances Reminder for June 2025

7th June 2025 – Due Date for TDS / TCS payment for deductions / collections during May 2025 15th June 2025 – Due date for issuance of TDS Certificates for Quarter 4 of FY: 2024-25…

View More TDS / TCS Compliances Reminder for June 2025TRACES: Download & Extract TDS & TCS Certificates

Once you have completed the process of filing your TDS or TCS returns, the next important step is to generate and distribute the relevant certificates…

View More TRACES: Download & Extract TDS & TCS CertificatesSection 271H: Penalty on taxpayers for not filing TDS or TCS returns

Section 271H of the Income Tax Act, 1961, outlines penalties related to the late filing, non-filing, or furnishing of incorrect information in Tax Deducted at…

View More Section 271H: Penalty on taxpayers for not filing TDS or TCS returnsMay – Pending TDS / TCS Compliances

30th May – Due date of issuing TCS certificate for Quarter 4 of Financial Year 2024-2025 31st May – Due date of filing TDS Returns…

View More May – Pending TDS / TCS CompliancesTDS Certificates – TDSMAN makes it Effortless

Managing TDS / TCS certificates post-return filing often involves multiple steps, interfaces and utilities. But with TDSMAN, everything comes together – neatly and efficiently –…

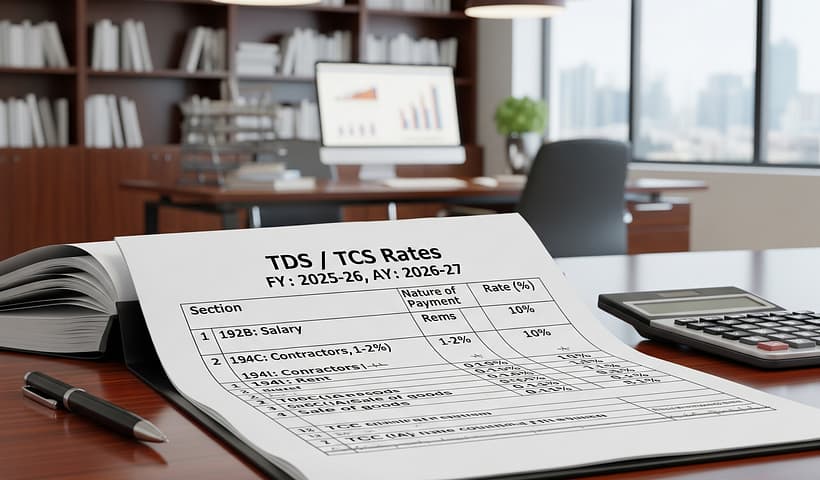

View More TDS Certificates – TDSMAN makes it EffortlessTDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)

A snapshot of the exemptions / deductions applicable for FY: 2024-25 (AY: 2025-26) under the Old & New Tax Regimes are summarized as under: Particulars…

View More Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)