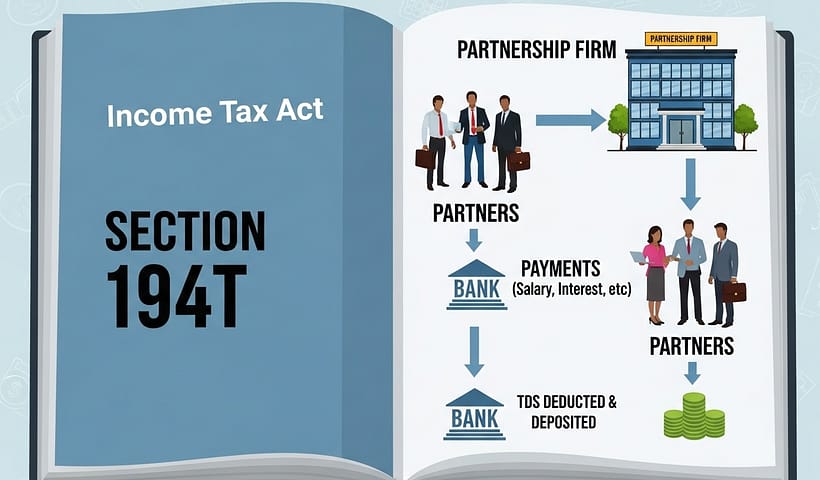

Budget 2024 introduced Section 194T, making certain payments from partnership firms (including LLPs) to partners liable for TDS. Previously, such payments were exempt from TDS,…

View More Section 194T: TDS on Payments by Partnership Firms to PartnersCategory: feature-post

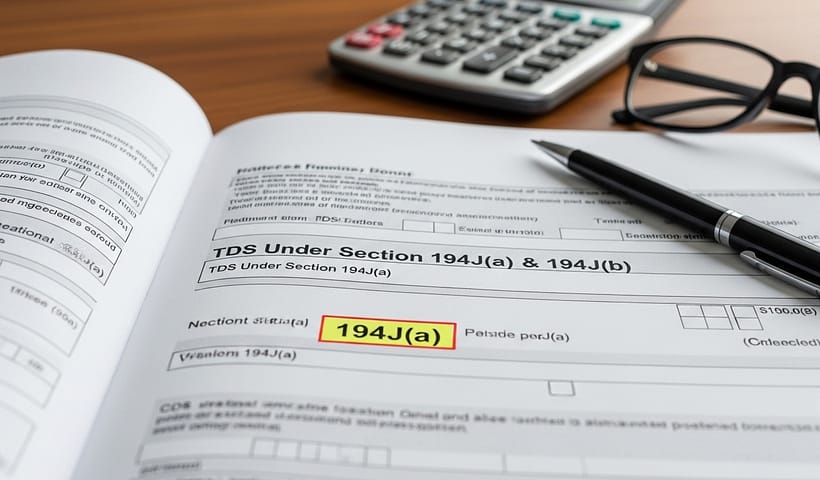

TDS Under Section 194J(a) & 194J(b)

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

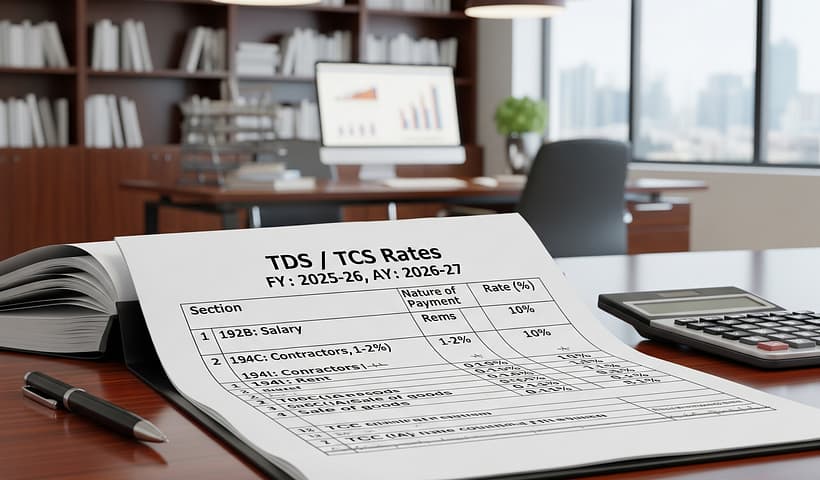

View More TDS Under Section 194J(a) & 194J(b)TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)Section 194C: TDS on Payments to Contractors

Section 194C of the Income Tax Act governs the deduction of tax on payments made to contractors or subcontractors for carrying out any work, including…

View More Section 194C: TDS on Payments to ContractorsTDS Under Section 194H – Brokerage & Commission

What is Section 194H? Section 194H of the Income Tax Act is specifically dedicated to TDS deducted on income earned through brokerage or commission by…

View More TDS Under Section 194H – Brokerage & Commission