7th January 2026 – Due date for TDS/TCS payment for deductions/collections during December 2025 15th January 2026 – Due date of filing TCS Returns for…

View More TDS / TCS Compliance Reminder for January 2026Category: Form 16

TDS / TCS Compliances Reminder for October 2025

7th October – Due date for TDS / TCS payment for deductions/collections during September 2025 15th October – Due date of filing TCS Return for Quarter 2 of Financial Year 2025-2026 30th…

View More TDS / TCS Compliances Reminder for October 2025TDS / TCS Certificates – Due Dates

The different types of TDS / TCS certificates need to be issued on time which is summarized in the table below: Form No. Certificate –…

View More TDS / TCS Certificates – Due DatesTDS / TCS Compliance Reminder for August 2025

7th August 2025 – Due date for TDS / TCS payment for deductions / collections during July 2025 15th August 2025 – Due date for issuing TDS…

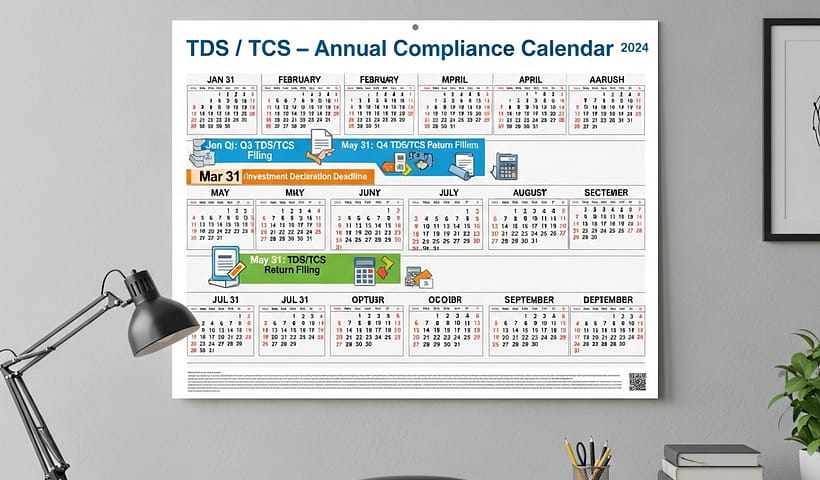

View More TDS / TCS Compliance Reminder for August 2025TDS / TCS – Annual Compliance Calendar

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance CalendarTDS / TCS Compliances Reminder for July 2025

7th July 2025 – Due date for TDS / TCS payment for deductions/collections during June 2025 15th July 2025 – Due date of filing TCS Return for Quarter 1 of Financial…

View More TDS / TCS Compliances Reminder for July 2025Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)

A snapshot of the exemptions / deductions applicable for FY: 2024-25 (AY: 2025-26) under the Old & New Tax Regimes are summarized as under: Particulars…

View More Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)Important resources – Form 24Q-Q4 (TDS on Salary)

With the Old & New Regime option given to employees for computing the income tax, it has become a tricky proposition even for the employers.…

View More Important resources – Form 24Q-Q4 (TDS on Salary)FY: 24-25 – Guide for income details of Employees – Form 24Q-Q4

It is mandatory to provide tax computation of each employee while filing the TDS Return on Salary for Quarter 4 as per the format of…

View More FY: 24-25 – Guide for income details of Employees – Form 24Q-Q4Tax Rebate – Section 87A

Section 87A provides a tax rebate to resident individual taxpayers, reducing their income tax liability if their taxable income falls within a specified threshold. The…

View More Tax Rebate – Section 87A