Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsCategory: Income Tax

CSI Download – Options through the Income Tax Portal

CSI file is provided by the Income Tax Department through its web portal for validating the Payment Challans reported in the quarterly TDS / TCS…

View More CSI Download – Options through the Income Tax PortalTDS Under Section 194J(a) & 194J(b)

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)Consequences of TDS defaults

Failure to deduct taxes or wrong deduction of TDS (non deposit, short deposit or late deposit) : Default/ Failure Section Nature of Demand Quantum of…

View More Consequences of TDS defaultsSignificance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsTDS Deduction on EPF Interest (New Rule)

Employee Provident Fund (EPF) was earlier not subject to tax and was tax-free in the hands of the employee. When a contribution was made, the…

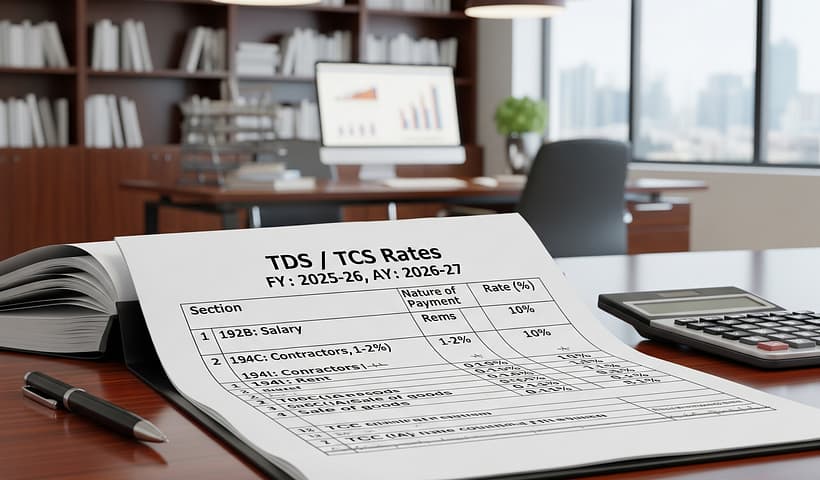

View More TDS Deduction on EPF Interest (New Rule)TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)

A snapshot of the exemptions / deductions applicable for FY: 2024-25 (AY: 2025-26) under the Old & New Tax Regimes are summarized as under: Particulars…

View More Old & New Tax Regime – Exemptions / Deductions (FY: 24-25)Computation of Income from House Property – Deduction of Interest u/s 24(b)

Income like rent on house property, annual value of property “deemed” to be let out are considered as income from House Property and is taxable…

View More Computation of Income from House Property – Deduction of Interest u/s 24(b)Section 89(1) Relief on Salary Arrears and Salary in Advance

Relief is provided under section 89(1), if salary pertaining to another period is received in advance/ or in arrears during a financial year, leading to…

View More Section 89(1) Relief on Salary Arrears and Salary in Advance