Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemCategory: PAN

Types of Corrections in TDS Returns

There are 6 types of corrections namely C1, C2, C3, C4, C5, C9. The following table briefly talks about each correction type: Type Corrections in:…

View More Types of Corrections in TDS ReturnsLate Payment Intimation – reasons & how to resolve?

In the TDS Return filed, the intimation for Late Payment can be received for the following reasons: Case #1: There was a delay in payment…

View More Late Payment Intimation – reasons & how to resolve?Section 194DA – TDS on Maturity Payment in Respect of Life Insurance Policy

Section 194DA of the Income Tax Act mandates the deduction of TDS on maturity proceeds of life insurance policies that are not exempt under Section…

View More Section 194DA – TDS on Maturity Payment in Respect of Life Insurance PolicyTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemTDS / TCS Compliances Reminder for October 2025

7th October – Due date for TDS / TCS payment for deductions/collections during September 2025 15th October – Due date of filing TCS Return for Quarter 2 of Financial Year 2025-2026 30th…

View More TDS / TCS Compliances Reminder for October 2025Section 194O – TDS on Payments by E-Commerce Operators to Participants

Section 194O was introduced in the Union Budget 2020 and came into effect from 1st October 2020. It requires e-commerce operators to deduct TDS on…

View More Section 194O – TDS on Payments by E-Commerce Operators to ParticipantsHealthy Practices for Error Free TDS Returns

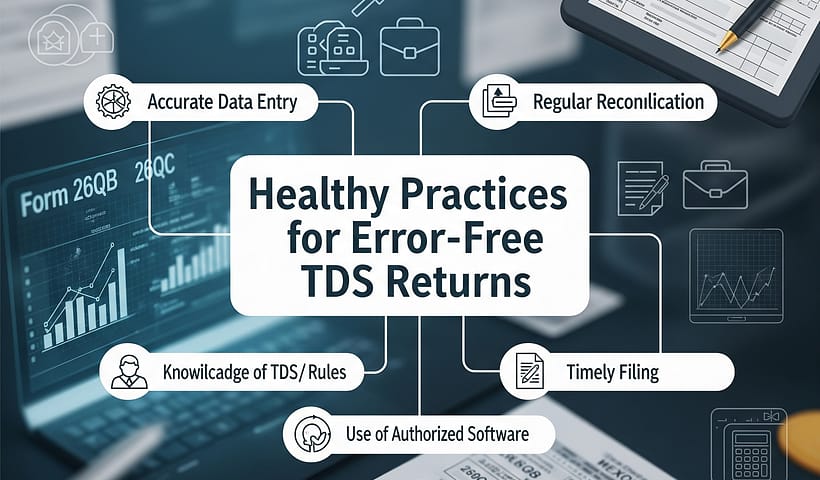

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsTDS / TCS Compliance Reminder for August 2025

7th August 2025 – Due date for TDS / TCS payment for deductions / collections during July 2025 15th August 2025 – Due date for issuing TDS…

View More TDS / TCS Compliance Reminder for August 2025Healthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS Returns