Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)Category: TCS Rates

Section 206C(1E): TCS on Cash Receipts for Goods and Services

Section 206C(1E) of the Income Tax Act, 1961 requires collection of tax at source (TCS) on high-value cash receipts arising from the sale of goods…

View More Section 206C(1E): TCS on Cash Receipts for Goods and ServicesSection 206C(1F): TCS on Sale of Motor Vehicles and Luxury Goods

Section 206C(1F) of the Income Tax Act, 1961 requires sellers to collect tax at source (TCS) on the sale of motor vehicles exceeding a prescribed…

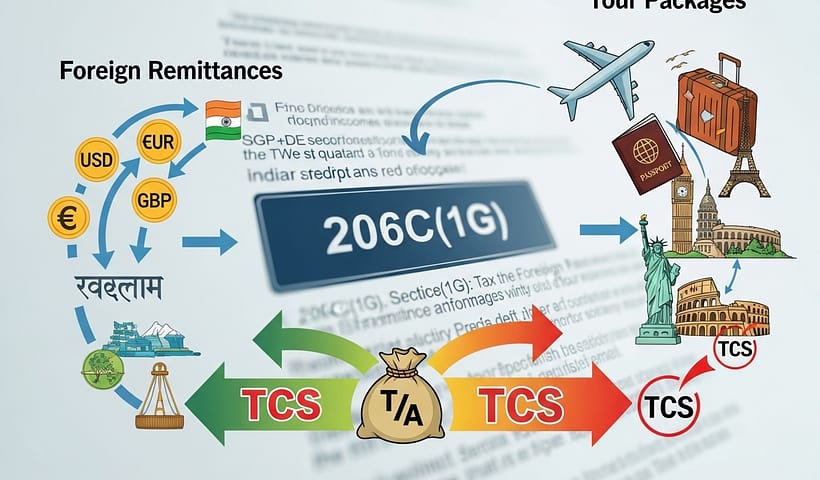

View More Section 206C(1F): TCS on Sale of Motor Vehicles and Luxury GoodsSection 206C(1G): TCS on Foreign Remittances and Tour Packages

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesSection 206C(1F): TCS on Sale of Motor Vehicles and Luxury Goods

Section 206C(1F) of the Income Tax Act, 1961 requires sellers to collect tax at source (TCS) on the sale of motor vehicles exceeding a prescribed…

View More Section 206C(1F): TCS on Sale of Motor Vehicles and Luxury GoodsSection 206C(1E): TCS on Cash Receipts for Goods and Services

Section 206C(1E) of the Income Tax Act, 1961 requires collection of tax at source (TCS) on high-value cash receipts arising from the sale of goods…

View More Section 206C(1E): TCS on Cash Receipts for Goods and ServicesSection 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)Section 206C(1C) – TCS on Toll Plaza, Parking, etc

Section 206C(1C) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by certain persons when they receive any amount as…

View More Section 206C(1C) – TCS on Toll Plaza, Parking, etc