Starting from 1st April 2025, a significant change is being introduced regarding the filing of Correction Statements. Under the current provisions, taxpayers have the flexibility…

View More Correction Statements: Limited to the Last Six YearsCategory: TCS return

Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)TDS / TCS Compliance Reminder for January 2026

7th January 2026 – Due date for TDS/TCS payment for deductions/collections during December 2025 15th January 2026 – Due date of filing TCS Returns for…

View More TDS / TCS Compliance Reminder for January 2026Section 206C(1E): TCS on Cash Receipts for Goods and Services

Section 206C(1E) of the Income Tax Act, 1961 requires collection of tax at source (TCS) on high-value cash receipts arising from the sale of goods…

View More Section 206C(1E): TCS on Cash Receipts for Goods and ServicesCSI Download – Options through the Income Tax Portal

CSI file is provided by the Income Tax Department through its web portal for validating the Payment Challans reported in the quarterly TDS / TCS…

View More CSI Download – Options through the Income Tax PortalSection 206C(1F): TCS on Sale of Motor Vehicles and Luxury Goods

Section 206C(1F) of the Income Tax Act, 1961 requires sellers to collect tax at source (TCS) on the sale of motor vehicles exceeding a prescribed…

View More Section 206C(1F): TCS on Sale of Motor Vehicles and Luxury GoodsTDS / TCS Compliances Reminder for October 2025

7th October – Due date for TDS / TCS payment for deductions/collections during September 2025 15th October – Due date of filing TCS Return for Quarter 2 of Financial Year 2025-2026 30th…

View More TDS / TCS Compliances Reminder for October 2025TDS Certificates – TDSMAN makes it Effortless

Managing TDS / TCS certificates post-return filing often involves multiple steps, interfaces and utilities. But with TDSMAN, everything comes together – neatly and efficiently –…

View More TDS Certificates – TDSMAN makes it EffortlessCorrection Statements: Limited to the Last Six Years

Starting from 1st April 2025, a significant change is being introduced regarding the filing of Correction Statements. Under the current provisions, taxpayers have the flexibility…

View More Correction Statements: Limited to the Last Six YearsTDS / TCS – Annual Compliance Calendar

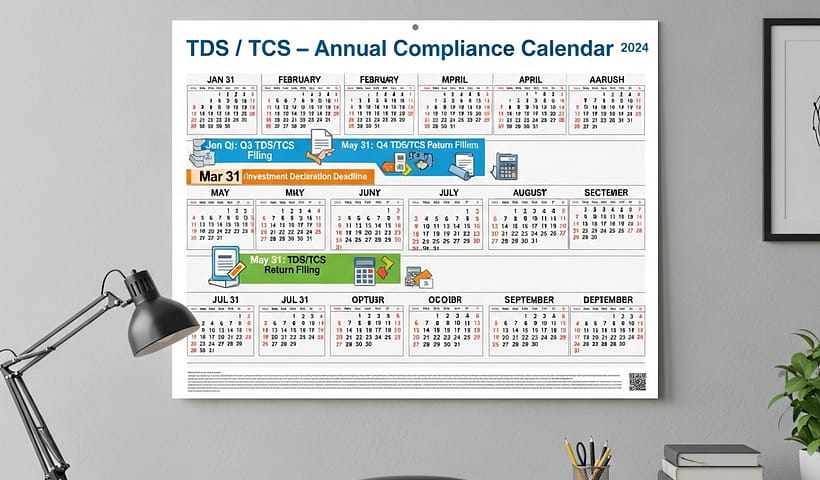

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance Calendar