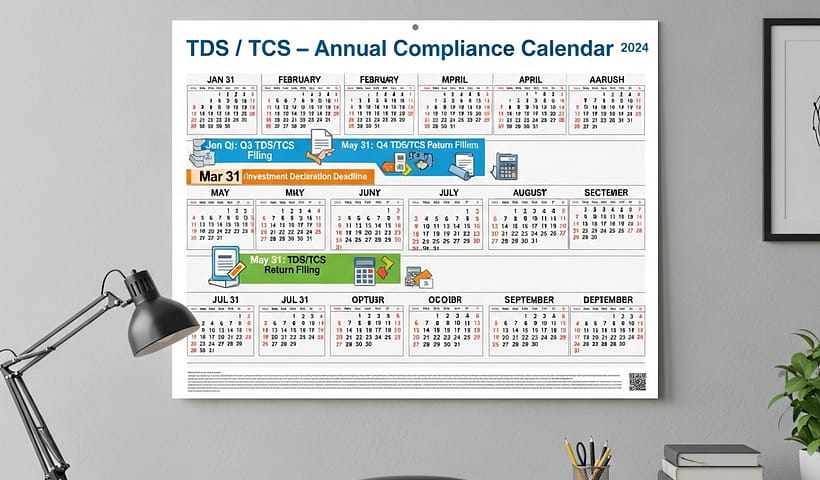

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance CalendarCategory: TCS

Tax Collected at Source

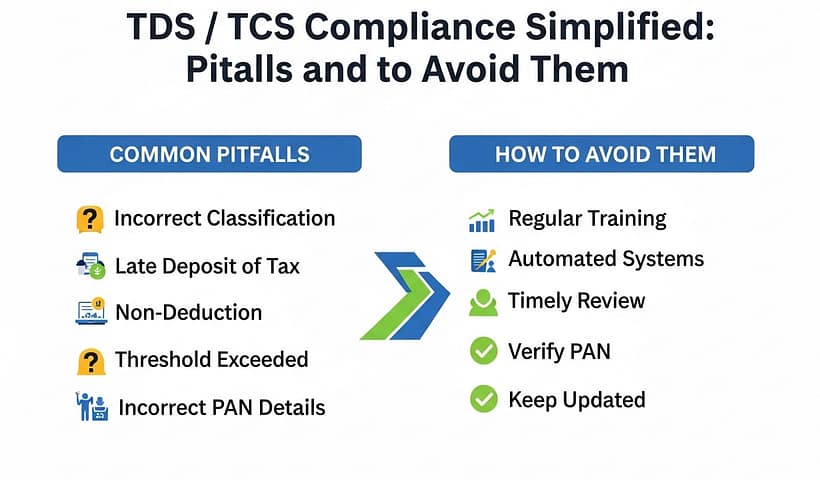

TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemSection 206C(1G): TCS on Foreign Remittances and Tour Packages

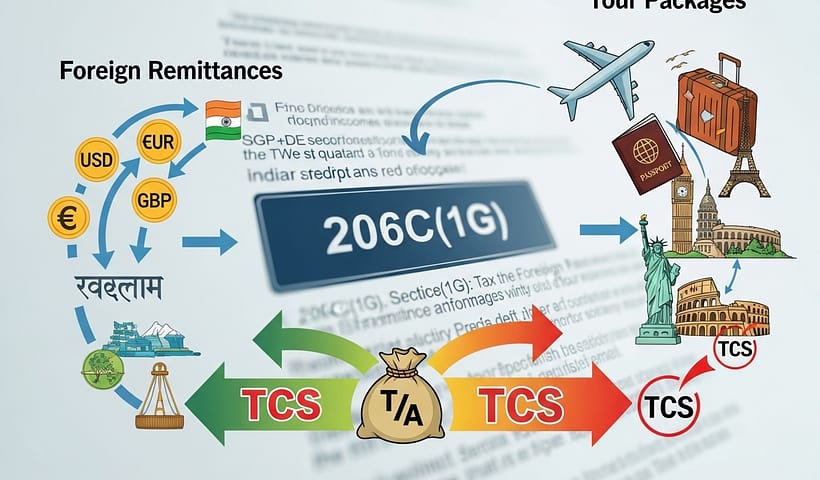

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesSection 206C(1F): TCS on Sale of Motor Vehicles and Luxury Goods

Section 206C(1F) of the Income Tax Act, 1961 requires sellers to collect tax at source (TCS) on the sale of motor vehicles exceeding a prescribed…

View More Section 206C(1F): TCS on Sale of Motor Vehicles and Luxury GoodsSection 206C(1E): TCS on Cash Receipts for Goods and Services

Section 206C(1E) of the Income Tax Act, 1961 requires collection of tax at source (TCS) on high-value cash receipts arising from the sale of goods…

View More Section 206C(1E): TCS on Cash Receipts for Goods and ServicesScope of TCS widened for Luxury Goods

In the Budget of FY:24-25, the scope of including more luxury items beyond motor cars was announced with the option to notify additions from time…

View More Scope of TCS widened for Luxury GoodsNew File Validation Utilities (FVUs) Version 9.2 & 2.188 released on 4th July, 2025

The latest versions of the File Validation Utilities (FVUs) have been released. The key updates are summarized as under: 1. Omission of Existing Flags/Remarks Remark…

View More New File Validation Utilities (FVUs) Version 9.2 & 2.188 released on 4th July, 2025Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)Section 206C(1C) – TCS on Toll Plaza, Parking, etc

Section 206C(1C) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by certain persons when they receive any amount as…

View More Section 206C(1C) – TCS on Toll Plaza, Parking, etcTDS / TCS Compliances Reminder for July 2025

7th July 2025 – Due date for TDS / TCS payment for deductions/collections during June 2025 15th July 2025 – Due date of filing TCS Return for Quarter 1 of Financial…

View More TDS / TCS Compliances Reminder for July 2025