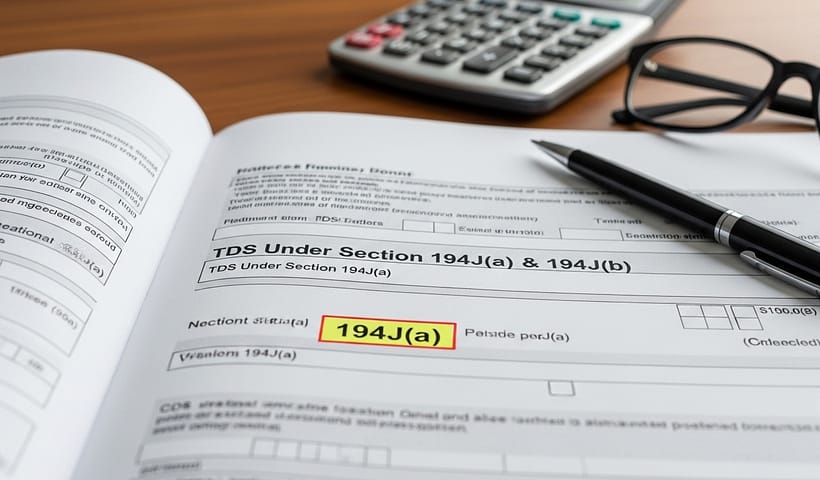

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)Category: TCS

Tax Collected at Source

Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsTDS / TCS Compliances Reminder for June 2025

7th June 2025 – Due Date for TDS / TCS payment for deductions / collections during May 2025 15th June 2025 – Due date for issuance of TDS Certificates for Quarter 4 of FY: 2024-25…

View More TDS / TCS Compliances Reminder for June 2025TRACES: Download & Extract TDS & TCS Certificates

Once you have completed the process of filing your TDS or TCS returns, the next important step is to generate and distribute the relevant certificates…

View More TRACES: Download & Extract TDS & TCS CertificatesMay – Pending TDS / TCS Compliances

30th May – Due date of issuing TCS certificate for Quarter 4 of Financial Year 2024-2025 31st May – Due date of filing TDS Returns…

View More May – Pending TDS / TCS CompliancesNew File Validation Utilities (FVUs) Version 9.1 & 2.187 released on 7th May, 2025

The Income Tax Department has released a new version of the File Validation Utility (FVU) to validate TDS / TCS returns before submission. This version…

View More New File Validation Utilities (FVUs) Version 9.1 & 2.187 released on 7th May, 2025The New Form 12BAA for Employees

The Central Board of Direct Taxes (CBDT) has recently notified vide Notification No. 112/2024, dated October 15, 2024 introduction of a new Form 12BAA, to…

View More The New Form 12BAA for EmployeesCoexistence of TDS 194Q and TCS 206C(1H) after Budget of 2021

Note: Effective FY: 2025-26, as per the Union Budget TCS on Sale of Goods has been withdrawn [Section 206(1H)]. Section 194Q – TDS on Purchase…

View More Coexistence of TDS 194Q and TCS 206C(1H) after Budget of 2021TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemTDS / TCS Compliances for February 2025

15th February 2025 – Due date for issuance of TDS Certificates for Q3 of FY: 2024-25 7th February 2025 – Due date for TDS / TCS payment…

View More TDS / TCS Compliances for February 2025