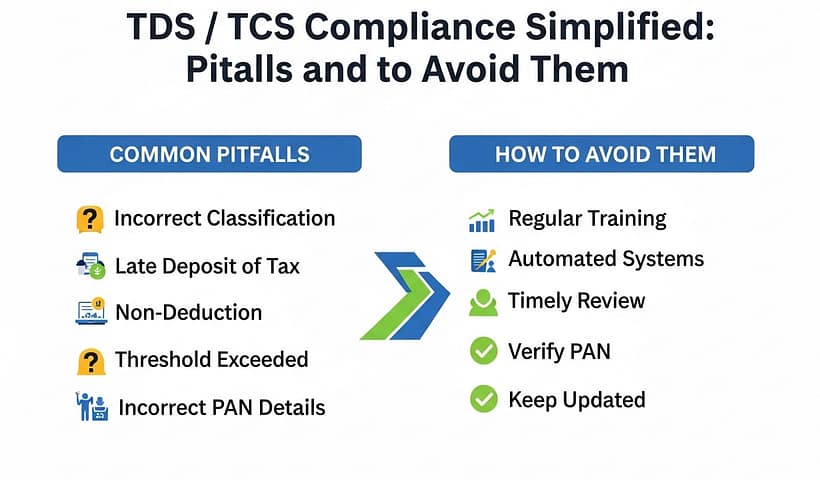

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemCategory: TDS Rates

Tax rates for various sections.

Section 194IB – TDS on payment of Rent by certain Individuals or HUF

As per Section 194IB, it is mandatory for persons such as individuals / HUF not liable to audit u/s 44AB to deduct tax for rent…

View More Section 194IB – TDS on payment of Rent by certain Individuals or HUFSection 194LA: TDS on Compensation for Compulsory Acquisition of Immovable Property

Section 194LA of the Income Tax Act, 1961, requires any person (referred to as the “payer”) making a payment to a resident (the “payee”) for…

View More Section 194LA: TDS on Compensation for Compulsory Acquisition of Immovable PropertySection 194DA – TDS on Maturity Payment in Respect of Life Insurance Policy

Section 194DA of the Income Tax Act mandates the deduction of TDS on maturity proceeds of life insurance policies that are not exempt under Section…

View More Section 194DA – TDS on Maturity Payment in Respect of Life Insurance PolicyTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemSection 194O – TDS on Payments by E-Commerce Operators to Participants

Section 194O was introduced in the Union Budget 2020 and came into effect from 1st October 2020. It requires e-commerce operators to deduct TDS on…

View More Section 194O – TDS on Payments by E-Commerce Operators to ParticipantsTDS Under Section 194H – Brokerage & Commission

What is Section 194H? Section 194H of the Income Tax Act is specifically dedicated to TDS deducted on income earned through brokerage or commission by…

View More TDS Under Section 194H – Brokerage & CommissionTDS Applicability U/S 194Q On Purchased Goods

In the Finance Act of 2021, the Indian government inserted Section 194Q. The Indian government’s intention behind enacting this law was to generate a trail…

View More TDS Applicability U/S 194Q On Purchased GoodsSection 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionals

Section 194M, introduced in the Budget of 2019, specifically targets individuals and Hindu Undivided Families (HUFs) who were previously exempt from TDS obligations. This section…

View More Section 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionalsTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them