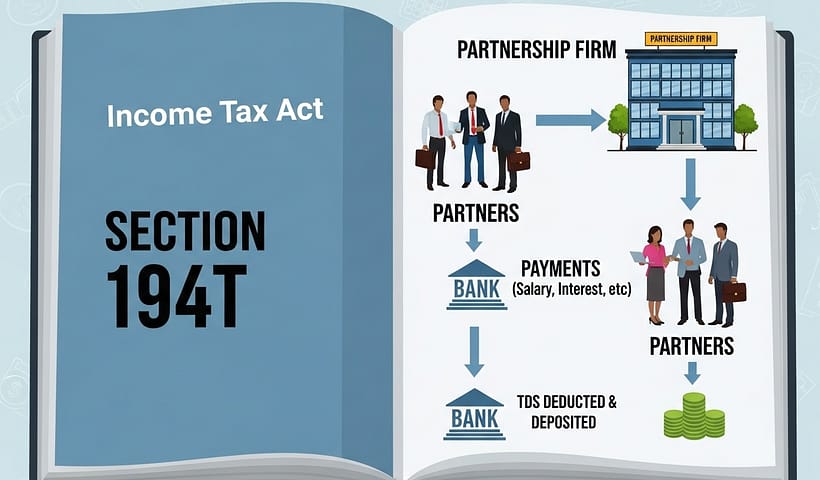

Budget 2024 introduced Section 194T, making certain payments from partnership firms (including LLPs) to partners liable for TDS. Previously, such payments were exempt from TDS,…

View More Section 194T: TDS on Payments by Partnership Firms to PartnersCategory: TDS Rates

Tax rates for various sections.

Section 194IB – TDS on payment of Rent by certain Individuals or HUF

As per Section 194IB, it is mandatory for persons such as individuals / HUF not liable to audit u/s 44AB to deduct tax for rent…

View More Section 194IB – TDS on payment of Rent by certain Individuals or HUFSection 194LA: TDS on Compensation for Compulsory Acquisition of Immovable Property

Section 194LA of the Income Tax Act, 1961, requires any person (referred to as the “payer”) making a payment to a resident (the “payee”) for…

View More Section 194LA: TDS on Compensation for Compulsory Acquisition of Immovable PropertySection 194O – TDS on Payments by E-Commerce Operators to Participants

Section 194O was introduced in the Union Budget 2020 and came into effect from 1st October 2020. It requires e-commerce operators to deduct TDS on…

View More Section 194O – TDS on Payments by E-Commerce Operators to ParticipantsTDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)TDS Exemption to Non-Residents on certain withdrawal from NSS

The Ministry of Finance, Dept. of Revenue has recently notified vide Notification No. 27/2025 dated 4th April 2025, that provides TDS exemption on certain withdrawals…

View More TDS Exemption to Non-Residents on certain withdrawal from NSSTDS / TCS – Changes w.e.f. 1st April 2025

1. Section 194D – Payment related to Insurance Commission The TDS @2% would apply on Section 194D – Payment related to Insurance Commission, till 31st…

View More TDS / TCS – Changes w.e.f. 1st April 2025Section 194G – TDS on Commission on Sale of Lottery Tickets

Any income earned by a person in the form of commission, remuneration, or prize on lottery tickets (deductee) who has been selling lottery tickets (also…

View More Section 194G – TDS on Commission on Sale of Lottery TicketsCBDT Circular No. 3/2025 – Income Tax Deduction from Salaries for March Quarter

The Central Board of Direct Taxes (CBDT) has released Circular No. 3/2025 on 20th February 2025, providing updated guidelines on Income-Tax Deduction from Salaries during…

View More CBDT Circular No. 3/2025 – Income Tax Deduction from Salaries for March QuarterSection 194DA – TDS on Maturity Payment in Respect of Life Insurance Policy

Section 194DA of the Income Tax Act mandates the deduction of TDS on maturity proceeds of life insurance policies that are not exempt under Section…

View More Section 194DA – TDS on Maturity Payment in Respect of Life Insurance Policy