Section 194M, introduced in the Budget of 2019, specifically targets individuals and Hindu Undivided Families (HUFs) who were previously exempt from TDS obligations. This section…

View More Section 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionalsCategory: TDS Sections

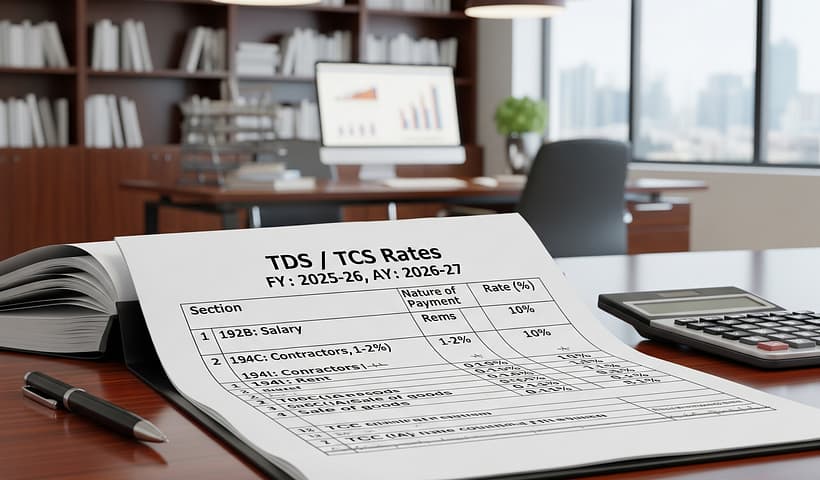

TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)Section 194I: An Overview of TDS on Rent

Section 194I of the Income Tax Act outlines the rules for deducting TDS on rent. This provision primarily applies to those paying rent for properties,…

View More Section 194I: An Overview of TDS on RentSection 194C: TDS on Payments to Contractors

Section 194C of the Income Tax Act governs the deduction of tax on payments made to contractors or subcontractors for carrying out any work, including…

View More Section 194C: TDS on Payments to ContractorsApplicability of Lower TDS / TCS Extended on Purchase of Goods

Effective from 1st October 2024, issue of certificates under Section 197 (lower deduction / collection) has been extended to include Sections 194Q and 206C. This…

View More Applicability of Lower TDS / TCS Extended on Purchase of GoodsTDS on Purchase of Immovable Property (Section 194-IA)

Starting from 1st October 2024, significant changes are being introduced in the rules on TDS on the purchase of immovable property under Section 194-IA. These…

View More TDS on Purchase of Immovable Property (Section 194-IA)Applicability of Lower TDS / TCS Extended on Purchase of Goods

Effective from 1st October 2024, issue of certificates under Section 197 (lower deduction / collection) has been extended to include Sections 194Q and 206C. This…

View More Applicability of Lower TDS / TCS Extended on Purchase of GoodsBudget 2024-25 | TDS / TCS – proposed changes

In the recently announced Budget on 23rd July, 2024, there are quite a few proposals related to TDS / TCS. These have been summarized in…

View More Budget 2024-25 | TDS / TCS – proposed changesTDS / TCS Rate Chart FY: 2024-25 (AY: 2025-26)

TDS RATE CHART FY: 2024-25 (AY: 2025-26) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2024-25 (AY: 2025-26)TDS / TCS at Higher Rates for Non-filers of IT-Return

1. Section 206AB Applicability: This shall be effective from 1st July’21 Specified person has not filed the ITR for 2 previous years and time limit…

View More TDS / TCS at Higher Rates for Non-filers of IT-Return