30th July – Due date of issuing TCS certificate for Quarter 1 of Financial Year 2025-2026 31st July – Due date of filing TDS Returns…

View More July – Pending TDS / TCS CompliancesCategory: TDSMAN Software

TDS Applicability U/S 194Q On Purchased Goods

In the Finance Act of 2021, the Indian government inserted Section 194Q. The Indian government’s intention behind enacting this law was to generate a trail…

View More TDS Applicability U/S 194Q On Purchased GoodsTDS / TCS – Annual Compliance Calendar

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance CalendarSection 206C(1G): TCS on Foreign Remittances and Tour Packages

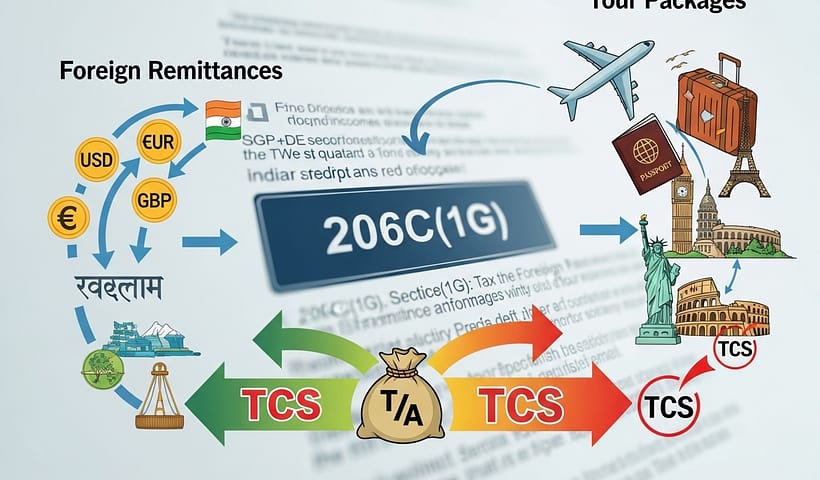

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesSection 206C(1F): TCS on Sale of Motor Vehicles and Luxury Goods

Section 206C(1F) of the Income Tax Act, 1961 requires sellers to collect tax at source (TCS) on the sale of motor vehicles exceeding a prescribed…

View More Section 206C(1F): TCS on Sale of Motor Vehicles and Luxury GoodsSection 206C(1E): TCS on Cash Receipts for Goods and Services

Section 206C(1E) of the Income Tax Act, 1961 requires collection of tax at source (TCS) on high-value cash receipts arising from the sale of goods…

View More Section 206C(1E): TCS on Cash Receipts for Goods and ServicesLate Payment Intimation – reasons & how to resolve?

In the TDS Return filed, the intimation for Late Payment can be received for the following reasons: Case #1: There was a delay in payment…

View More Late Payment Intimation – reasons & how to resolve?Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)Section 206C(1C) – TCS on Toll Plaza, Parking, etc

Section 206C(1C) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by certain persons when they receive any amount as…

View More Section 206C(1C) – TCS on Toll Plaza, Parking, etcTDS / TCS Compliances Reminder for July 2025

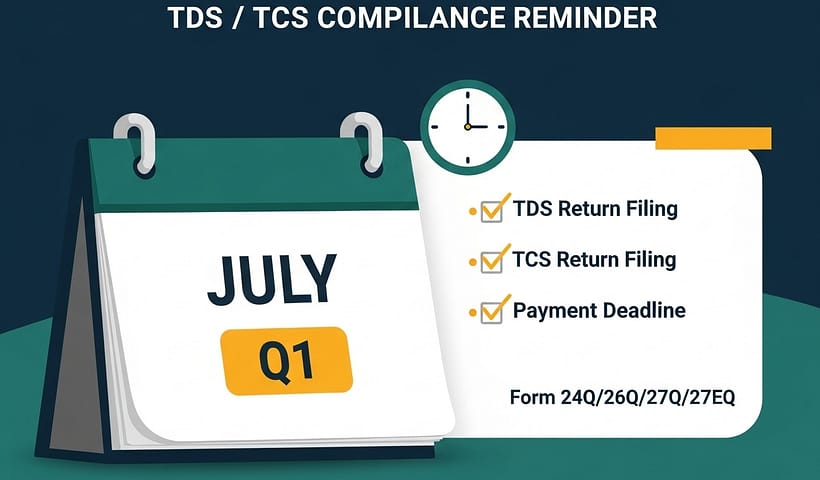

7th July 2025 – Due date for TDS / TCS payment for deductions/collections during June 2025 15th July 2025 – Due date of filing TCS Return for Quarter 1 of Financial…

View More TDS / TCS Compliances Reminder for July 2025