For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsCategory: Traces

TRACES: Download & Extract TDS & TCS Certificates

Once you have completed the process of filing your TDS or TCS returns, the next important step is to generate and distribute the relevant certificates…

View More TRACES: Download & Extract TDS & TCS CertificatesTypes of Corrections in TDS Returns

There are 6 types of corrections namely C1, C2, C3, C4, C5, C9. The following table briefly talks about each correction type: Type Corrections in:…

View More Types of Corrections in TDS ReturnsTDS Deduction on EPF Interest (New Rule)

Employee Provident Fund (EPF) was earlier not subject to tax and was tax-free in the hands of the employee. When a contribution was made, the…

View More TDS Deduction on EPF Interest (New Rule)Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

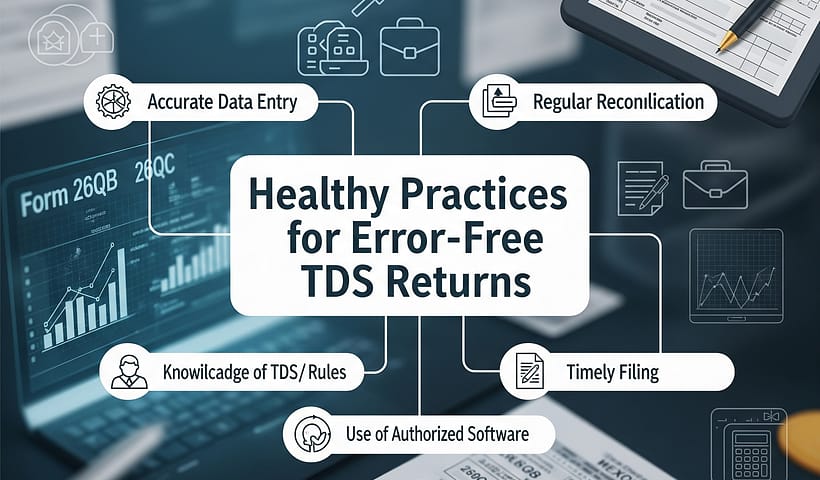

View More Significance of the ‘REMARKS’ in TDS ReturnsHealthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsTDS / TCS Certificates – Due Dates

The different types of TDS / TCS certificates need to be issued on time which is summarized in the table below: Form No. Certificate –…

View More TDS / TCS Certificates – Due DatesTDS Certificates – TDSMAN makes it Effortless

Managing TDS / TCS certificates post-return filing often involves multiple steps, interfaces and utilities. But with TDSMAN, everything comes together – neatly and efficiently –…

View More TDS Certificates – TDSMAN makes it EffortlessTDS / TCS Compliance Reminder for August 2025

7th August 2025 – Due date for TDS / TCS payment for deductions / collections during July 2025 15th August 2025 – Due date for issuing TDS…

View More TDS / TCS Compliance Reminder for August 2025Healthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS Returns