The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)Category: Traces

Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsTRACES: Download & Extract TDS & TCS Certificates

Once you have completed the process of filing your TDS or TCS returns, the next important step is to generate and distribute the relevant certificates…

View More TRACES: Download & Extract TDS & TCS CertificatesTDS Certificates – TDSMAN makes it Effortless

Managing TDS / TCS certificates post-return filing often involves multiple steps, interfaces and utilities. But with TDSMAN, everything comes together – neatly and efficiently –…

View More TDS Certificates – TDSMAN makes it EffortlessTDS Deduction on EPF Interest (New Rule)

Employee Provident Fund (EPF) was earlier not subject to tax and was tax-free in the hands of the employee. When a contribution was made, the…

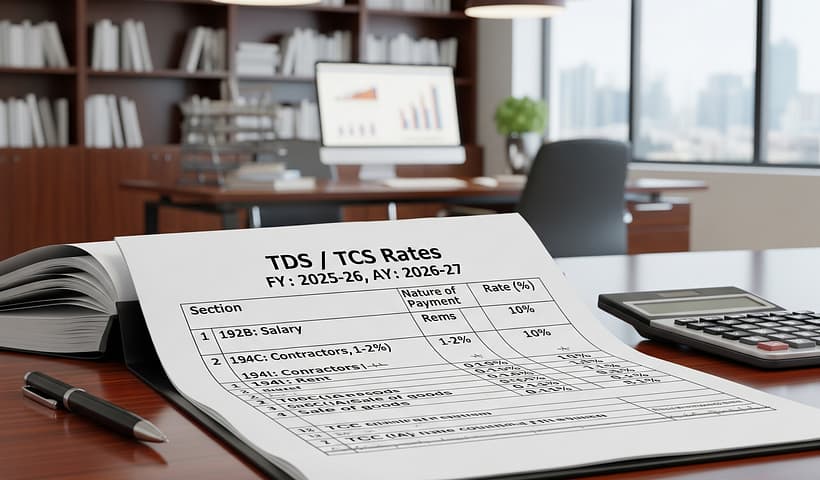

View More TDS Deduction on EPF Interest (New Rule)TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)

TDS RATE CHART FY: 2025-26 (AY: 2026-27) Section Nature of Payment Threshold Indv / HUF Others Rs. TDS Rate (%) 192 Salaries – Slab Rate…

View More TDS / TCS Rate Chart FY: 2025-26 (AY: 2026-27)TDS / TCS Compliances for May 2025

7th May 2025 – Due date for TDS / TCS payment for deductions / collections during April 2025 15th May – Due date of filing…

View More TDS / TCS Compliances for May 2025TDS / TCS Compliances Reminder for April & May 2025

7th April 2025 – Due date for TCS payment for collections during March 2025 30th April 2025 – Due date for TDS payment for deductions…

View More TDS / TCS Compliances Reminder for April & May 2025Coexistence of TDS 194Q and TCS 206C(1H) after Budget of 2021

Note: Effective FY: 2025-26, as per the Union Budget TCS on Sale of Goods has been withdrawn [Section 206(1H)]. Section 194Q – TDS on Purchase…

View More Coexistence of TDS 194Q and TCS 206C(1H) after Budget of 2021Key TDS / TCS proposed changes in Budget 2025-26

The Union Budget 2025-26 brings notable changes to tax deduction and collection processes, aimed at streamlining compliance and administrative procedures. These amendments focus on revising…

View More Key TDS / TCS proposed changes in Budget 2025-26