TDS / TCS Certificates – Due Dates

The different types of TDS / TCS certificates need to be issued on time which is summarized in the table below: Form No. Certificate –…

View More TDS / TCS Certificates – Due DatesTDS Certificates – TDSMAN makes it Effortless

Managing TDS / TCS certificates post-return filing often involves multiple steps, interfaces and utilities. But with TDSMAN, everything comes together – neatly and efficiently –…

View More TDS Certificates – TDSMAN makes it EffortlessCorrection Statements: Limited to the Last Six Years

Starting from 1st April 2025, a significant change is being introduced regarding the filing of Correction Statements. Under the current provisions, taxpayers have the flexibility…

View More Correction Statements: Limited to the Last Six YearsTDS / TCS Compliance Reminder for August 2025

7th August 2025 – Due date for TDS / TCS payment for deductions / collections during July 2025 15th August 2025 – Due date for issuing TDS…

View More TDS / TCS Compliance Reminder for August 2025July – Pending TDS / TCS Compliances

30th July – Due date of issuing TCS certificate for Quarter 1 of Financial Year 2025-2026 31st July – Due date of filing TDS Returns…

View More July – Pending TDS / TCS CompliancesTDS / TCS Non-Compliance: Costs, Risks and Prevention

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are essential components of India’s tax system to ensure better tax compliance and reduce…

View More TDS / TCS Non-Compliance: Costs, Risks and PreventionTDS Applicability U/S 194Q On Purchased Goods

In the Finance Act of 2021, the Indian government inserted Section 194Q. The Indian government’s intention behind enacting this law was to generate a trail…

View More TDS Applicability U/S 194Q On Purchased GoodsHealthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsSection 195 – TDS on Payments to Non-Residents

What is Section 195? Section 195 of the Income Tax Act, 1961 mandates that any person (including individuals, Hindu Undivided Families (HUFs), firms, or companies)…

View More Section 195 – TDS on Payments to Non-ResidentsTDS / TCS – Annual Compliance Calendar

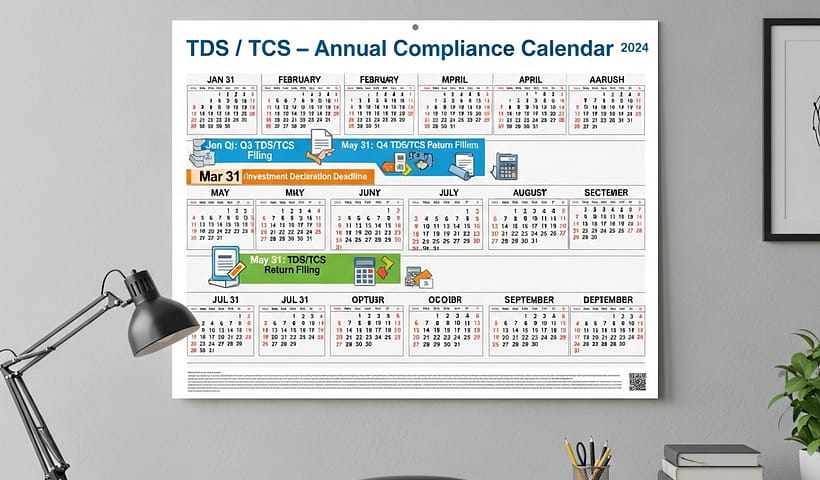

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance Calendar