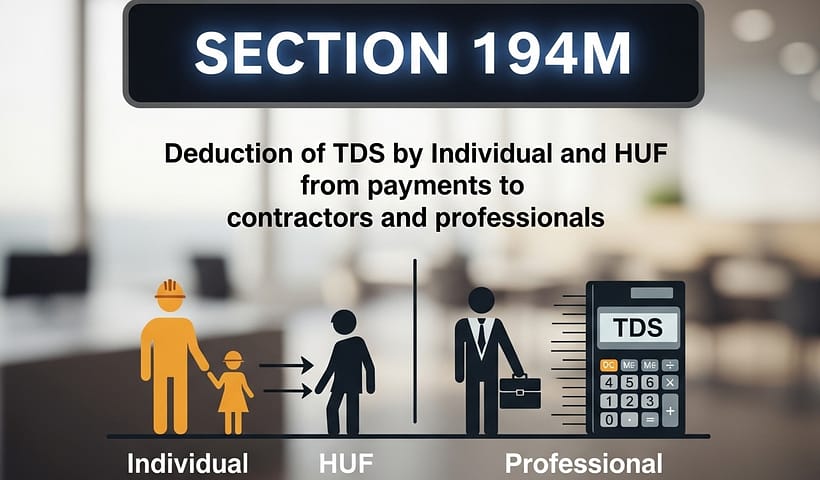

Section 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionals

Section 194M, introduced in the Budget of 2019, specifically targets individuals and Hindu Undivided Families (HUFs) who were previously exempt from TDS obligations. This section…

View More Section 194M – Deduction of TDS by Individual and HUF from payments to contractors and professionalsTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

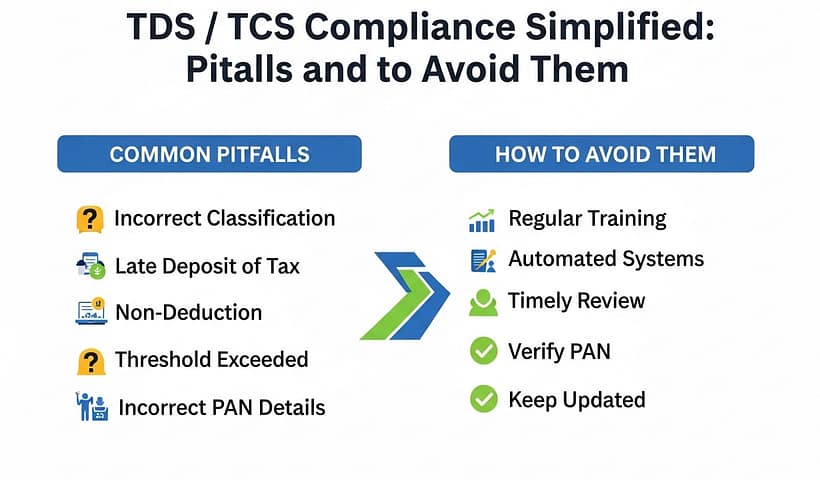

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemSection 206C(1G): TCS on Foreign Remittances and Tour Packages

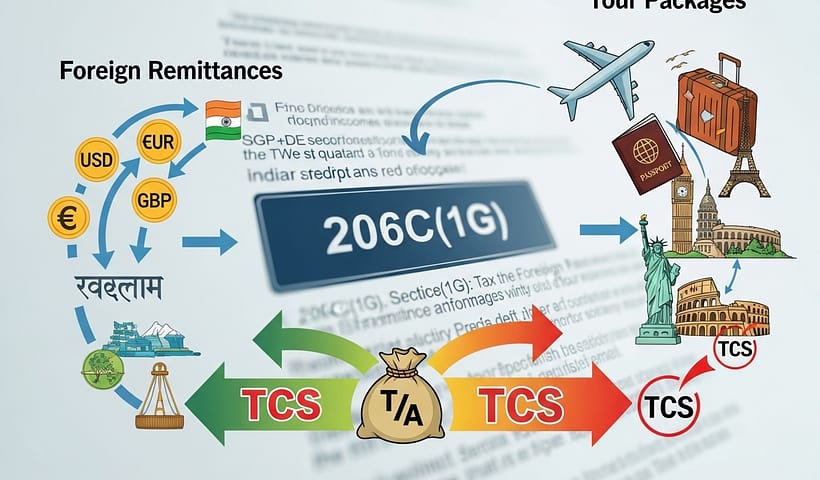

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesSection 194T: TDS on Payments by Partnership Firms to Partners

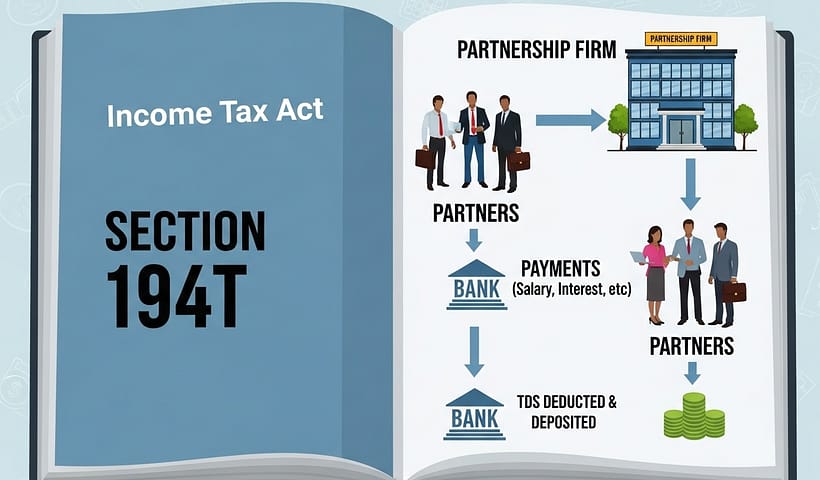

Budget 2024 introduced Section 194T, making certain payments from partnership firms (including LLPs) to partners liable for TDS. Previously, such payments were exempt from TDS,…

View More Section 194T: TDS on Payments by Partnership Firms to PartnersSection 206C(1F): TCS on Sale of Motor Vehicles and Luxury Goods

Section 206C(1F) of the Income Tax Act, 1961 requires sellers to collect tax at source (TCS) on the sale of motor vehicles exceeding a prescribed…

View More Section 206C(1F): TCS on Sale of Motor Vehicles and Luxury GoodsSection 206C(1E): TCS on Cash Receipts for Goods and Services

Section 206C(1E) of the Income Tax Act, 1961 requires collection of tax at source (TCS) on high-value cash receipts arising from the sale of goods…

View More Section 206C(1E): TCS on Cash Receipts for Goods and ServicesLate Payment Intimation – reasons & how to resolve?

In the TDS Return filed, the intimation for Late Payment can be received for the following reasons: Case #1: There was a delay in payment…

View More Late Payment Intimation – reasons & how to resolve?Section 194IB – TDS on payment of Rent by certain Individuals or HUF

As per Section 194IB, it is mandatory for persons such as individuals / HUF not liable to audit u/s 44AB to deduct tax for rent…

View More Section 194IB – TDS on payment of Rent by certain Individuals or HUFScope of TCS widened for Luxury Goods

In the Budget of FY:24-25, the scope of including more luxury items beyond motor cars was announced with the option to notify additions from time…

View More Scope of TCS widened for Luxury GoodsNew File Validation Utilities (FVUs) Version 9.2 & 2.188 released on 4th July, 2025

The latest versions of the File Validation Utilities (FVUs) have been released. The key updates are summarized as under: 1. Omission of Existing Flags/Remarks Remark…

View More New File Validation Utilities (FVUs) Version 9.2 & 2.188 released on 4th July, 2025