There are 6 types of corrections namely C1, C2, C3, C4, C5, C9. The following table briefly talks about each correction type: Type Corrections in:…

View More Types of Corrections in TDS ReturnsTag: accurate TDS returns

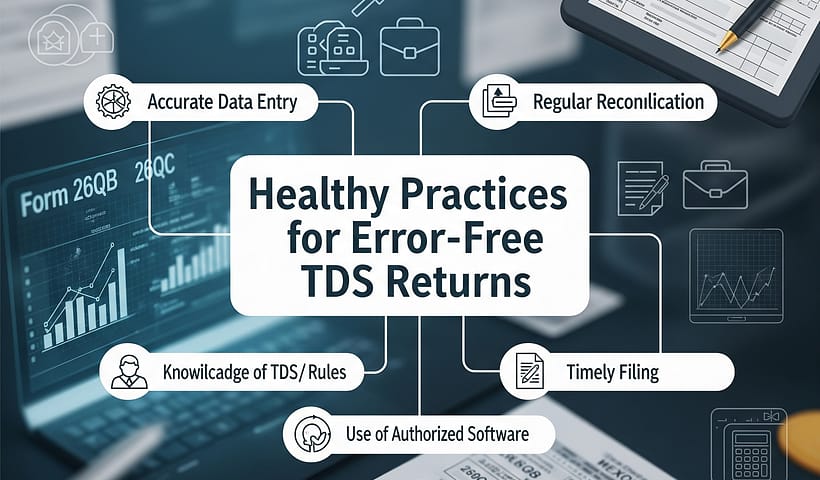

Healthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsHealthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsHealthy Practices for Error Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error Free TDS ReturnsTypes of Corrections in TDS Returns

There are 6 types of corrections namely C1, C2, C3, C4, C5, C9. The following table briefly talks about each correction type: Type Corrections in:…

View More Types of Corrections in TDS ReturnsHealthy Practices for Error-Free TDS Returns

Preparing TDS Returns is a simple process and usually does not require any external assistance. However, it is well advised to follow few practices that…

View More Healthy Practices for Error-Free TDS ReturnsTypes of Corrections in TDS Returns

There are 6 types of corrections namely C1, C2, C3, C4, C5, C9. The following table briefly talks about each correction type: Type Corrections in:…

View More Types of Corrections in TDS ReturnsTips to avoid Defaults in TDS Returns

Make sure taxes are deducted on time and at correct deduction rates /amount. The applicable section under which the deduction falls should be correctly applied.…

View More Tips to avoid Defaults in TDS ReturnsTDSMAN Top acceptance percentage as per NSDL data

As per data provide by the Income Tax Dept., NSDL has recently published the “Software vendorwise percentage of correction TDS/TCS statements accepted and rejected at TIN”…

View More TDSMAN Top acceptance percentage as per NSDL data