For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsTag: Form 26Q

Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsNew File Validation Utilities (FVUs) Version 9.2 & 2.188 released on 4th July, 2025

The latest versions of the File Validation Utilities (FVUs) have been released. The key updates are summarized as under: 1. Omission of Existing Flags/Remarks Remark…

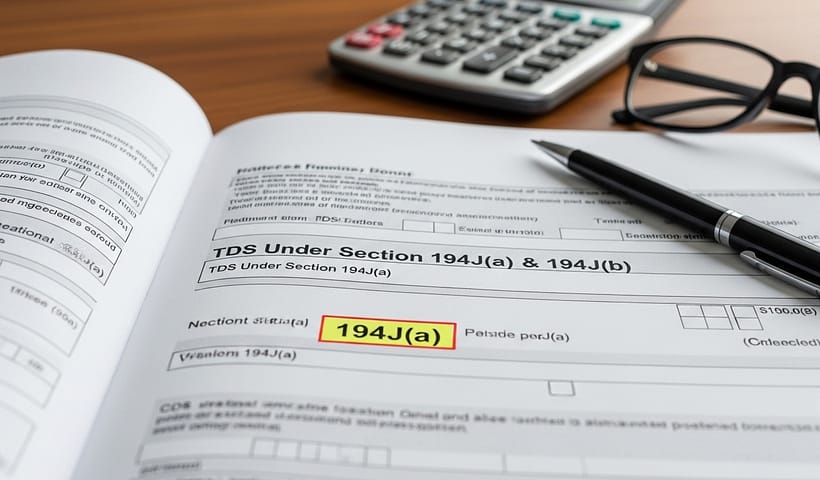

View More New File Validation Utilities (FVUs) Version 9.2 & 2.188 released on 4th July, 2025TDS Under Section 194J(a) & 194J(b)

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsNew File Validation Utilities (FVUs) Version 9.1 & 2.187 released on 7th May, 2025

The Income Tax Department has released a new version of the File Validation Utility (FVU) to validate TDS / TCS returns before submission. This version…

View More New File Validation Utilities (FVUs) Version 9.1 & 2.187 released on 7th May, 2025What is TRACES?

TRACES (TDS Reconciliation Analysis and Correction Enabling System) is an online platform provided by the Income Tax Department of India. It facilitates the following services…

View More What is TRACES?Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsWhat is TRACES?

TRACES (TDS Reconciliation Analysis and Correction Enabling System) is an online platform provided by the Income Tax Department of India. It facilitates the following services…

View More What is TRACES?Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS Returns