Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)Tag: Form 27EQ

Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsSignificance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

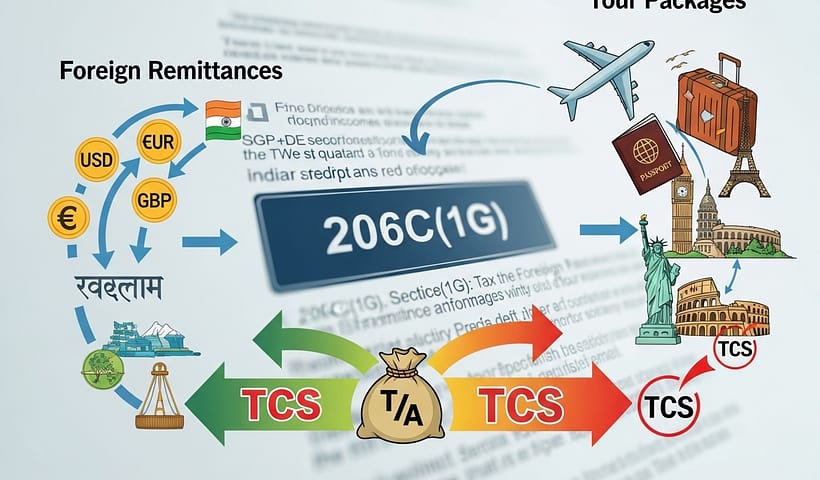

View More Significance of the ‘REMARKS’ in TDS ReturnsSection 206C(1G): TCS on Foreign Remittances and Tour Packages

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesSection 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsNew File Validation Utilities (FVUs) Version 9.1 & 2.187 released on 7th May, 2025

The Income Tax Department has released a new version of the File Validation Utility (FVU) to validate TDS / TCS returns before submission. This version…

View More New File Validation Utilities (FVUs) Version 9.1 & 2.187 released on 7th May, 2025Significance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsSignificance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS ReturnsSignificance of the ‘REMARKS’ in TDS Returns

For the different payment types, as per applicability, standard TDS rates are specified. Under certain provisions of the Act, there could be deviation from this…

View More Significance of the ‘REMARKS’ in TDS Returns