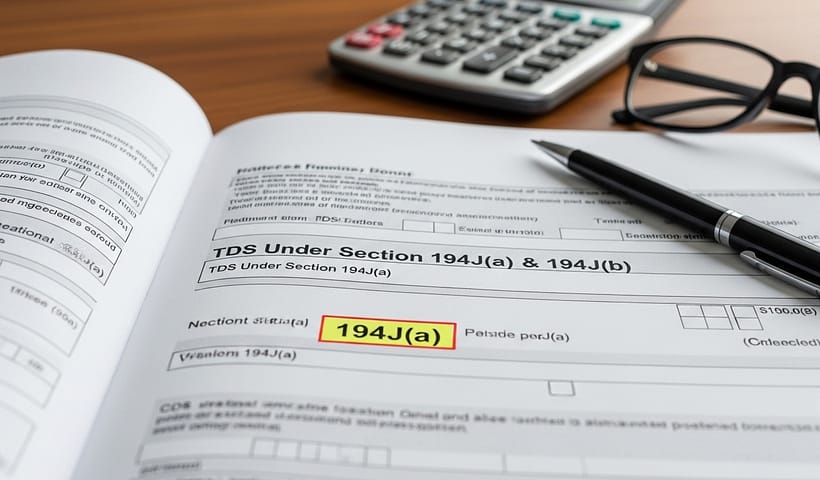

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)Tag: New provision

Section 194Q – TDS on Purchase of Goods

Applicability: This shall be effective 1st July’21 TDS Rate: 0.1% on amount exceeding Rs 50L 5% if PAN is not furnished When to Deduct? Assessee…

View More Section 194Q – TDS on Purchase of GoodsSection 194Q – TDS on Purchase of Goods (Union Budget 2021)

Applicability: This shall be effective 1st July’21 TDS Rate: 0.1% on amount exceeding Rs 50L 5% if PAN is not furnished When to Deduct? Assessee…

View More Section 194Q – TDS on Purchase of Goods (Union Budget 2021)New Section 194Q – TDS on Purchase of Goods (Union Budget 2021)

Applicability: This shall be effective 1st July’21 TDS Rate: 0.1% on amount exceeding Rs 50L 5% if PAN is not furnished When to Deduct? Assessee…

View More New Section 194Q – TDS on Purchase of Goods (Union Budget 2021)TCS on sale of goods – Amendment from 1st October 2020

In the Finance Act 2020, a new sub section has been added which is vide Section 206C (1H) to give effect to the Tax collected…

View More TCS on sale of goods – Amendment from 1st October 2020New Section 194Q – TDS on Purchase of Goods (Union Budget 2021)

Applicability: This shall be effective 1st July’21 TDS Rate: 0.1% on amount exceeding Rs 50L 5% if PAN is not furnished When to Deduct? Assessee…

View More New Section 194Q – TDS on Purchase of Goods (Union Budget 2021)New Section 194Q – TDS on Purchase of Goods (Union Budget 2021)

Applicability: This shall be effective 1st July’21 TDS Rate: 0.1% on amount exceeding Rs 50L 5% if PAN is not furnished When to Deduct? Assessee…

View More New Section 194Q – TDS on Purchase of Goods (Union Budget 2021)TCS on sale of goods – Amendment from 1st October 2020

In the Finance Act 2020, a new sub section has been added which is vide Section 206C (1H) to give effect to the Tax collected…

View More TCS on sale of goods – Amendment from 1st October 2020TDS Under Section 194J(a) & 194J(b)

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from August…

View More TDS Under Section 194J(a) & 194J(b)