There are 6 types of corrections namely C1, C2, C3, C4, C5, C9. The following table briefly talks about each correction type: Type Corrections in:…

View More Types of Corrections in TDS ReturnsTag: NSDL

TDS / TCS Compliances Reminder for October 2025

7th October – Due date for TDS / TCS payment for deductions/collections during September 2025 15th October – Due date of filing TCS Return for Quarter 2 of Financial Year 2025-2026 30th…

View More TDS / TCS Compliances Reminder for October 2025TDS / TCS Compliances Reminder for July 2025

7th July 2025 – Due date for TDS / TCS payment for deductions/collections during June 2025 15th July 2025 – Due date of filing TCS Return for Quarter 1 of Financial…

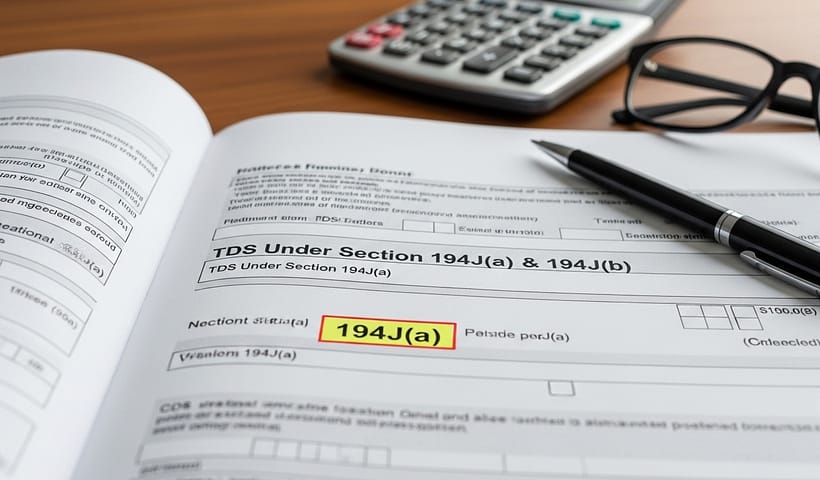

View More TDS / TCS Compliances Reminder for July 2025TDS Under Section 194J(a) & 194J(b)

The existing section code 194J (i.e. Fees for Professional or Technical Services) has been sub-divided now into two sections, 194J(a) and 194J(b), effective from 7th…

View More TDS Under Section 194J(a) & 194J(b)TDS / TCS Compliances Reminder for July 2024

7th July 2024 – Due date for TDS / TCS payment for deductions/collections during June 2024 15th July 2024 – Due date of filing TCS Return for Quarter 1 of…

View More TDS / TCS Compliances Reminder for July 2024TDS / TCS Compliances Reminder for May 2024

7th May 2024 – Due date for TDS / TCS payment for deductions/collections during April 2024 15th May 2024 – Due date of filing TCS…

View More TDS / TCS Compliances Reminder for May 2024Online TDS / TCS / Demand Payment using Challan ITNS 281

Challan no. ITNS 281 is used by deductors to deposit TDS, TCS and demand payment. Following details are necessary to fill while payment of Challan…

View More Online TDS / TCS / Demand Payment using Challan ITNS 281TDS / TCS Compliance Reminder for October 2022

7th October 2022 – Due date for TDS/TCS payment for deductions/collections during September 2022 15th October 2022 – Due date of filing TCS Return for Quarter 2 of Financial Year 2022-2023…

View More TDS / TCS Compliance Reminder for October 2022New FVUs Version 7.7 & 2.173 released by NSDL on 12th July 2022

Owing to the new encryption certificate applicable for the File Validation Utility, new versions of File Validation Utility (FVUs) for e-TDS/TCS statements has been released…

View More New FVUs Version 7.7 & 2.173 released by NSDL on 12th July 2022TDS / TCS Compliances Reminder for July 2022

7th July 2022 – Due date for TDS/TCS payment for deductions/collections during June 2022 15th July 2022 – Due date of filing TCS Return for Quarter 1 of Financial Year 2022-2023…

View More TDS / TCS Compliances Reminder for July 2022