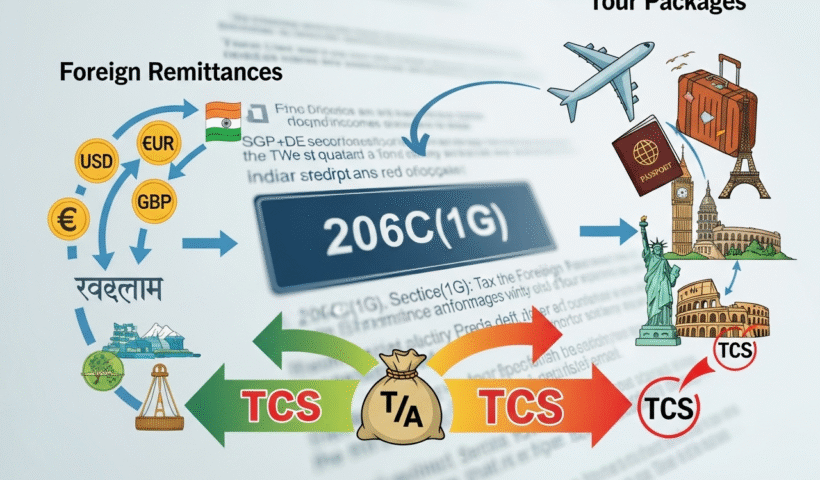

Section 206C(1G) of the Income Tax Act, 1961 mandates tax collection at source on specified foreign transactions. It applies when an authorized dealer receives funds…

View More Section 206C(1G): TCS on Foreign Remittances and Tour PackagesTag: Section 206CC

Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)