What is the Late Filing Fee u/s 234(E) of the Income Tax Act, 1961? As per section 234E, where a person fails to file the…

View More FAQ on Late TDS / TCS FilingTag: Section 234E

January – Pending TDS / TCS Compliances

30th January – Due date of issuing TCS certificate for Quarter 3 of Financial Year 2025-2026 31st January – Due date of filing TDS Returns…

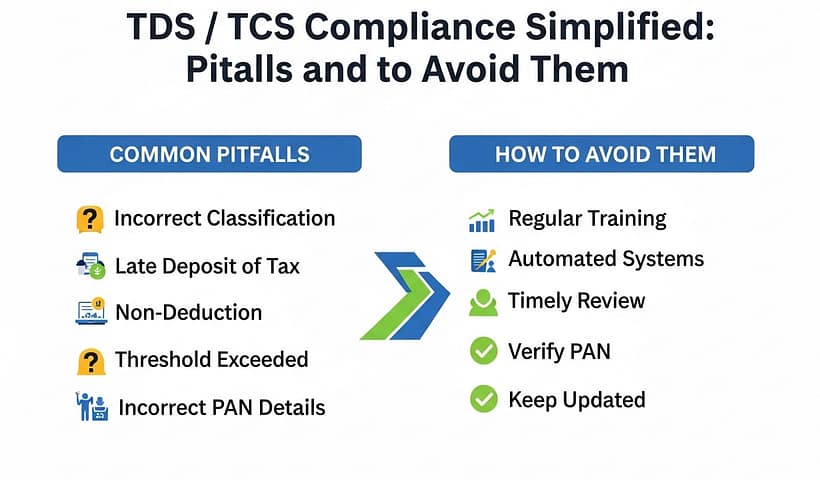

View More January – Pending TDS / TCS CompliancesTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemSection 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)October – Pending TDS / TCS Compliances

30th October – Due date of issuing TCS certificate for Quarter 2 of Financial Year 2025-2026 31st October – Due date of filing TDS Returns…

View More October – Pending TDS / TCS CompliancesTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

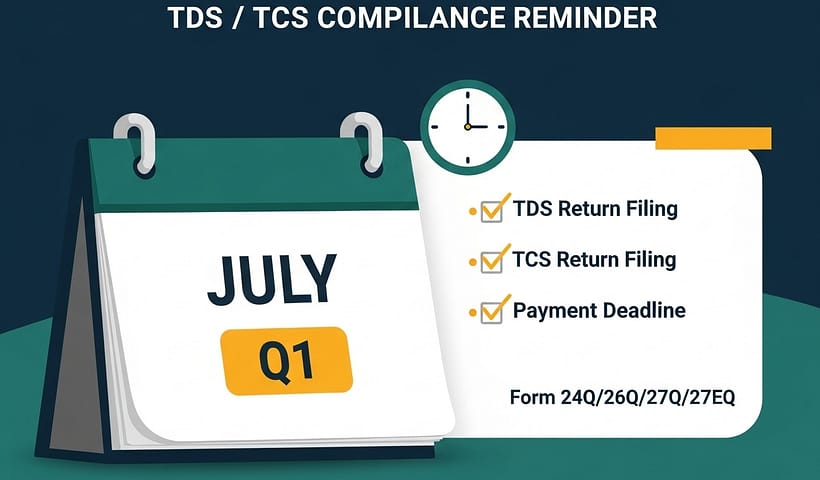

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemJuly – Pending TDS / TCS Compliances

30th July – Due date of issuing TCS certificate for Quarter 1 of Financial Year 2025-2026 31st July – Due date of filing TDS Returns…

View More July – Pending TDS / TCS CompliancesTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemSection 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)

Section 206C(1) of the Income Tax Act, 1961 mandates the collection of tax at source (TCS) by sellers related to specific goods. It applies at…

View More Section 206C(1) of the Income Tax Act: Tax Collection at Source (TCS)May – Pending TDS / TCS Compliances

30th May – Due date of issuing TCS certificate for Quarter 4 of Financial Year 2024-2025 31st May – Due date of filing TDS Returns…

View More May – Pending TDS / TCS Compliances