30th January – Due date of issuing TCS certificate for Quarter 3 of Financial Year 2025-2026 31st January – Due date of filing TDS Returns…

View More January – Pending TDS / TCS CompliancesTag: Section 271H

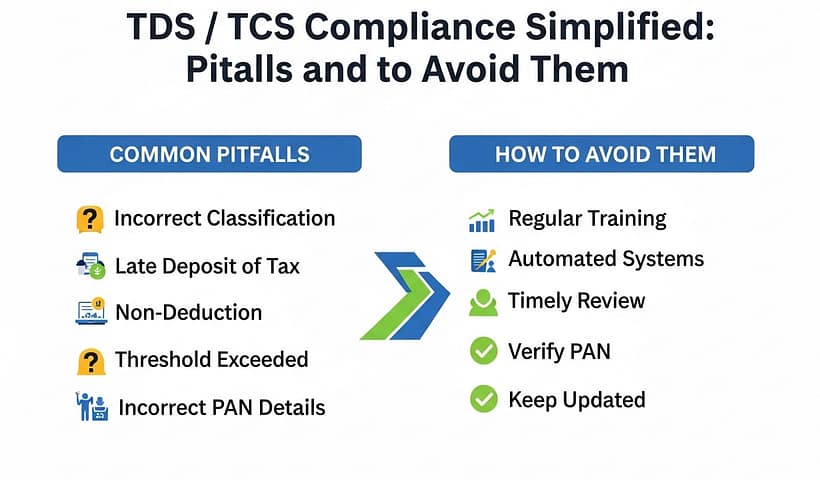

TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemOctober – Pending TDS / TCS Compliances

30th October – Due date of issuing TCS certificate for Quarter 2 of Financial Year 2025-2026 31st October – Due date of filing TDS Returns…

View More October – Pending TDS / TCS CompliancesTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemJuly – Pending TDS / TCS Compliances

30th July – Due date of issuing TCS certificate for Quarter 1 of Financial Year 2025-2026 31st July – Due date of filing TDS Returns…

View More July – Pending TDS / TCS CompliancesTDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemMay – Pending TDS / TCS Compliances

30th May – Due date of issuing TCS certificate for Quarter 4 of Financial Year 2024-2025 31st May – Due date of filing TDS Returns…

View More May – Pending TDS / TCS CompliancesTDS / TCS – Changes w.e.f. 1st April 2025

1. Section 194D – Payment related to Insurance Commission The TDS @2% would apply on Section 194D – Payment related to Insurance Commission, till 31st…

View More TDS / TCS – Changes w.e.f. 1st April 2025TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid Them

Tax Deducted at Source (TDS) & Tax Collected at Source (TCS) compliance is a crucial responsibility for all deductors and collectors. While the process is…

View More TDS / TCS Compliance Simplified: Common Pitfalls and How to Avoid ThemLast date for filing of TDS returns for Q4 of FY: 2016-17 – 31st May, 2017

The last date of filing TDS returns for the fourth quarter of FY 2016-17 falls due on 31st May, 2017. It is very important to…

View More Last date for filing of TDS returns for Q4 of FY: 2016-17 – 31st May, 2017