7th October – Due date for TDS / TCS payment for deductions/collections during September 2025 15th October – Due date of filing TCS Return for Quarter 2 of Financial Year 2025-2026 30th…

View More TDS / TCS Compliances Reminder for October 2025Tag: TCS Compliances

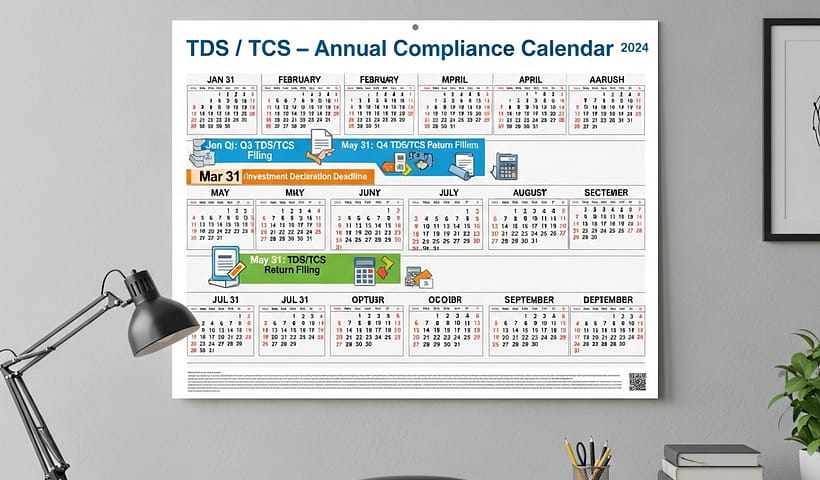

TDS / TCS – Annual Compliance Calendar

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance CalendarTDS / TCS Compliances Reminder for July 2025

7th July 2025 – Due date for TDS / TCS payment for deductions/collections during June 2025 15th July 2025 – Due date of filing TCS Return for Quarter 1 of Financial…

View More TDS / TCS Compliances Reminder for July 2025TDS / TCS – Annual Compliance Calendar

TDS / TCS – Deposit & Filing of Returns TDS / TCS – deductions / collections during the course of the month needs to be…

View More TDS / TCS – Annual Compliance CalendarTDS / TCS Compliances Reminder for July 2024

7th July 2024 – Due date for TDS / TCS payment for deductions/collections during June 2024 15th July 2024 – Due date of filing TCS Return for Quarter 1 of…

View More TDS / TCS Compliances Reminder for July 2024TDS / TCS Compliance Reminder for October 2022

7th October 2022 – Due date for TDS/TCS payment for deductions/collections during September 2022 15th October 2022 – Due date of filing TCS Return for Quarter 2 of Financial Year 2022-2023…

View More TDS / TCS Compliance Reminder for October 2022TDS / TCS Compliances Reminder for July 2022

7th July 2022 – Due date for TDS/TCS payment for deductions/collections during June 2022 15th July 2022 – Due date of filing TCS Return for Quarter 1 of Financial Year 2022-2023…

View More TDS / TCS Compliances Reminder for July 2022TDS / TCS Compliances for June 2021

7th June 2021 – Due Date for TDS / TCS payment for deductions / collections during May 2021 30th June 2021 – Due date of filing TDS Return for Quarter 4 of Financial Year 2020-2021 *Please…

View More TDS / TCS Compliances for June 2021TDS / TCS Compliances for May 2021

7th May 2021 – Due Date for TDS / TCS payment for deductions / collections during April 2021 15th May 2021 – Due Date for Filling…

View More TDS / TCS Compliances for May 2021